The Dow Jones climbed 79.92 points. The S&P 500 added 2.92 points and the Nasdaq rose 5.32 points.

The worst and most hated sectors caught a bid today. Shares of large banks, materials and industrial companies, which are down sharply so far this year, were the biggest gainers today. Gold and gold miners have also been acting well. With the world at negative rates, how could gold not catch a bid? Materials stocks (XLB) are up 6% just this week alone, but are still down 5% for the year. Glad we got out of SMN when we did, right at the top too.

Crude oil continues to be manic. At about 8 am oil was down at 31.60 and getting hammered, by 9:30 it rallied very hard to 33.50 with a huge reversal. Guess where it closed? Right where it started….at 31.60.

Even professional crude trades are loosing their minds, and I know a few, and they are all ordering doubles at the bar.

Here is the 15 minute chart of crude today.

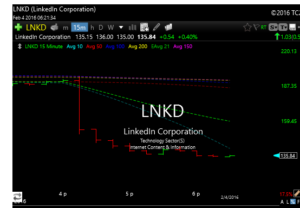

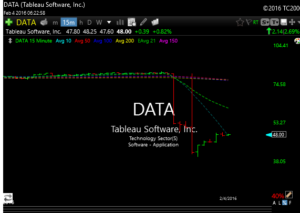

In other news LNKD, DATA and DECK are getting creamed in the after market after reporting bad earnings. Here is a look at the action.

LNKD– down about 55 points

DATA– down about 35 points

DECK– down 10%

This can’t bode well for the Nasdaq tomorrow which hasn’t been able to get out of its own way lately and hasn’t seen green in three days. Dont forget that GOOG gave back its entire move and then some after a good earnings report. This is a bad tape right now and if you miss on earnings you get crucified…..if you beat you can get crucified.

Now you know why I’m cautious and NOT long. Something isn’t right here and I’m not going to piss away my money or yours here. Patience will pay.

Utilities, REITs and the bond market are all telling us that there is no way way rates are going up. But I’m starting to think that unlike past years, this dynamic could be hurtful, and not helpful for stocks. Time will tell.

See you in the morning. Its Friday and its the jobs report.

Joe