Investors got a reprieve from the early-year drubbing in stocks today, as some of the most beaten-down corners of the market carved out sharp gains.

The Dow notched its biggest one-day gain of the year, rising 228 points, or 1.4%, to 16379.

Other major indexes also reclaimed ground. The S&P rose 32 points, or 1.7%, to 1922, while the Nazzy gained 89 points, or 2%.

Energy companies notched the sharpest gains among S&P stocks, with the index’s energy sector rising 4.5%.

They went coo coo for cocoa puffs today. The market rolled over at the open, but as oil firmed, so did stocks, and starting at around 10:15 to 10:45 am the SPX added a quick 35 points. Strong to say the least.

As you can see in the chart below, the SPX came within about 6 points of lateral support. That was my target, but because I dont jump in day one, I didn’t get long. I may not even get long tomorrow. I’m OK with that, I like to watch the damage improve a bit first. This is great action for day traders and scalpers though. As a swing trader I have to be more careful.

The average stock in the S&P 500 is down more than 20% from its 52-week high. An ugly state of affairs and charts have a lot of work to do here. NOTHING has changed on the macro front, so this was a technical rally and I think we will see a lot of this in 2016. I also think we will probably retest lows again. We also could be teetering on a recession. Don’t worry, its all good, if things implode there is a lot to make on the short side.

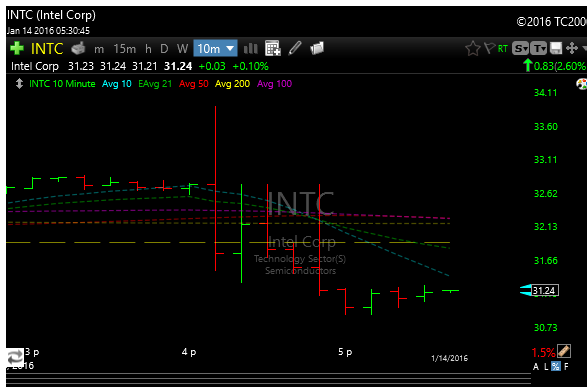

Intel reported after the close, the # didn’t seem all that bad, but they are taking it down in after market trading. Here’s a look below, as a result, SMH is down as well.

Best Buy (BBY) one of our shorts collapsed after a crappy earnings report this morning. I covered 1/3 and I am holding the rest for now.

FAST reports tomorrow morning, so I took off half today just to play it safe. I dont usually stay long or short through earnings, but I had a good feeling about BBY.

Have a great evening and I ll see you in the morning.

JOe