The Dow rallied in the final hour of trading, closing in positive territory and capping a day of wide swings.

The Dow gained 52 points to 16399, after swinging between gains and losses throughout the session and falling as much as 114 points in intraday trade.

Oil prices remained firmly in negative territory, keeping shares of energy companies lower. The S&P 500 energy sector index lost 2.1%, as U.S. oil prices slumped 5.3% to $31.41 a barrel, its lowest level since 2003.

Mining had a wonderful day as FCX dropped 20%, CNX fell 10%, BTU fell 20% and ACI filed bankruptcy. Its the end of an era for coal. Who would have imagined?

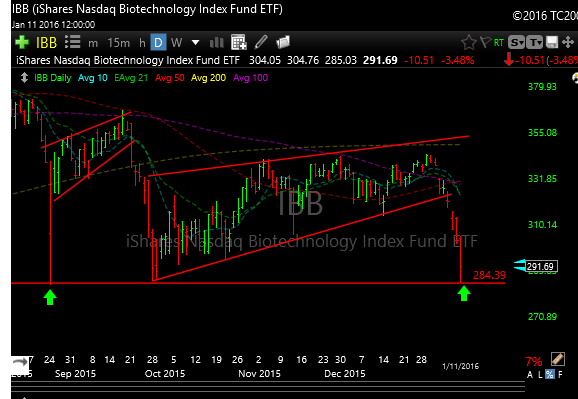

Some interesting levels were hit today, for example the IBB went over support by just 50 cents, than bounced. Amazing how support levels work huh?

Also XLB hit my target today, well, within a few pennies anyway.

Also pretty amazing is that XLE came within 10 cents of October support.

As I mentioned in last nights post, by all measures we are healthily oversold and we did manage a slight rally at the end of the day. I don’t fancy myself a bottom caller, or else I would have laid in some longs today. I’ve been fooled before, so honestly I’d rather pay up if things turn. There will still be a lot of money to make.

Crude oil is about as oversold as you can get and today it took out those 2009 lows. Ugly, but even if its going to 20, it should get a technical bounce at some point soon.

See you in the morning

Joe