US equity markets attempted to stabilize into the NY open after yesterday’s thrashing. By day’s end, stock indices made little headway, if any. The breadth was much improved from yesterday, with pockets of strength to be found in REITs, healthcare, homebuilders, and lodging. Banks and oil stocks lagged. Crude prices dropped another 2.5%, while the dollar momentum continued. The greenback hit a fresh 12-year high against the Canadian dollar and 1-month high versus the Euro.

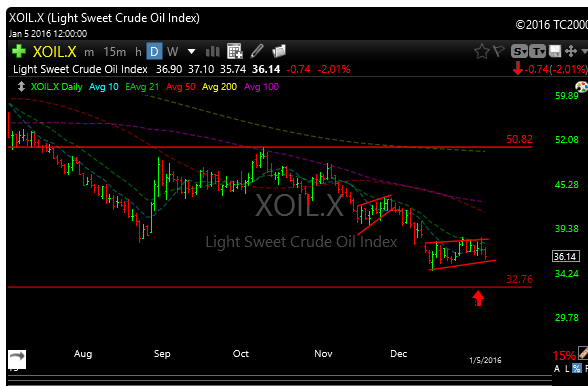

Crude looks heavy here and it wouldn’t surprise me if it took one more leg lower. I’m not saying it happens, but it wouldn’t surprise me. We are close to 2009 lows and a break of 35 and I think we get there quickly.

I took a few profits today, both on the long and short side. Its always good to feed the ducks a little when they’re quacking. They have to eat too.

Right now the bears are clearly in control and most charts look very bad. However, in the big picture, the S&P is really only down about 20 points since the year started. Yes I know we only have two days of data, but the market looks and feels a lot worse than it is.

The Russell 2000, the Nasdaq and Dow look much worse though.

Current Profit/Loss here

See you folks in the morning.

Joe