For you folks that don’t watch the market like a peregrine falcon from open to close (lucky you), here is what the market did today.

Janet “Aunt Bea” Yellen made her monthly appearance today and didn’t raise rates, but talked about well, who knows, maybe December, maybe never????

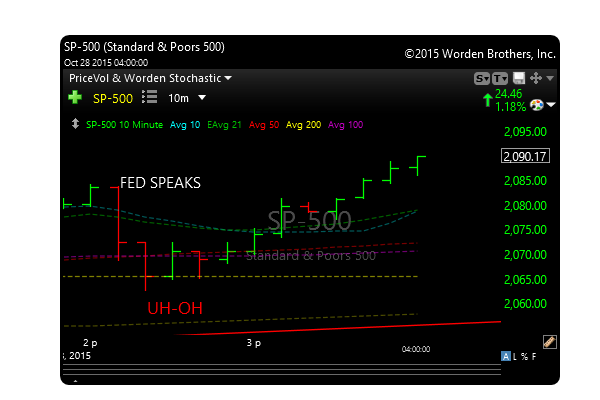

Bottom line, the market took whatever she said as hawkish…..well at first. As you can see, the SPX (other indexes too) did a quick visit to the wood chipper. Dramatic, as the SPX lost 20 handles in 20 minutes.

Calmer heads prevailed, and then we ripped into the bell to close on the highs. Good clean fun right? I’m getting to old for this. Its rarely the first move after the fed speaks.

The NASDAQ finds itself pennies from all time highs and the Russell 2000 finally woke up and joined the party after lagging for so long.

The SPX is interesting here. Not from the sense of here it has come from, but where can it go from here. As you can see in the chart below, the pattern is at the very apex of the bearish wedge. Yes, the SPX has rallied over a 100 points and its still in a bear wedge. This is a big spot as it tried to poke above the apex of that wedge today. See the red arrow.

If it can continue higher, then the all time highs are about 40 handles above today’s close.

Added BTU as a short sale today.

Regarding TWTR, we’re still alive after that disaster of an earnings report last night. Still long.