Yesterday’s bearish action, whereby many key indexes and etf’s backed away from resistance, sucked in a bunch of shorts I would imagine. The market looked tired, listless and rudderless. I was one of them.

The market launched higher today based on more QE efforts from Europe, as well as an 8% explosion from MCD which hit all time highs. MCD had a lot to do with the move in the DOW-30.

To be fair, most of the etf’s that I follow had good days, anywhere from 1.5 to 2% up. Healthcare and biotech though continued to lag.

After the market closed, GOOG, AMZN & MSFT reported staggeringly good #’s, so the Nasdaq should have quite a day higher tomorrow. I am not short Nasdaq, but I am short the Russell and that does continue to underperform, but with this action, perhaps it will soon lift higher too.

QQQ is seeing about +1.70 in aftermarket.

The U.S. Dollar finally had a downtrend breakout and is approaching lateral resistance. If this strength keeps up it could cause a problem for multinationals and energy, but right now its not a concern for the market.

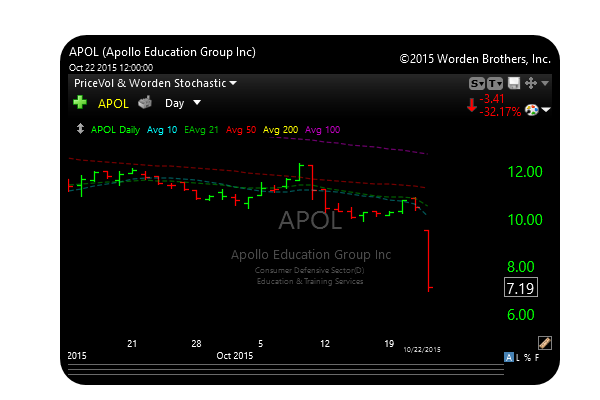

We discussed APOL as a short idea on the chatroom earlier this week and it imploded today. We are short LOPE (same business) and the chart looks weak so I am hoping for the same result.

Regarding LOPE, its in a bear wedge, the macd indicator broke lower and sell volume is picking up.

Its always the way it goes when I make a bearish observation and then the market rips in my face.

A continuation day for the bulls is already in the bag based on GOOG, MSFT and AMZN.

See you guys in the morning.