This market continues to hang around here and it will be interesting to see if it can make the next move higher. As you can see, we are at the recent highs for the SPX and if it can clear this level then maybe it can tag the 2050-2080.

The other three indexes all find themselves at lateral resistance as well, so this is a big spot for the market.

U.S. stocks finished Monday’s range-bound session marginally higher, as steep losses for energy stocks, following a drop in oil prices, kept a lid on the main indexes.

IBM reported their 16th consecutive loss after the market closed today and is getting crushed after ours, so that could put a lid on the market tomorrow, at least in the early going. Morgan Stanley also dropped 5% on a bad report. We all knew this would be a miserable quarter.

Chinese growth slowed to 6.9% . That was the first break below 7% since 2009.

WTW doubled today on news that Oprah Winfrey was particularly fond of the fettuccine Alfredo. Actually is was because she took a 10% stake. About 70% of the float was short too, so BOOM.

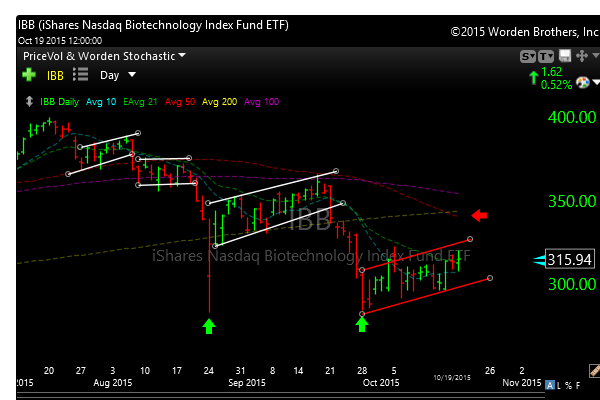

Biotech (IBB) is bouncing a bit, but big picture the chart is still a mess as it has completed its death cross (50 day ma crosses down below its 200 day ma) and it finds itself in its fourth bear flag formation.

Many stocks are in deep downtrends and broken. Some are basing and are starting to look a little better. I’m still leaning short as the market edges higher. I will keep you posted if things change.

See you in the morning.