I really hate feeling stupid, but the economic data is so weak that it puts the fed out of play and that pushes stocks higher. This is the theme yet again. Goldman’s quarterly profits dripped 36% and the stock popped 3%. Bad news is back to being good again. Anything to keep the dreaded fed in abeyance.

I’m still fairly bearish on the market based on my positions, but I sure looked bad today because biotech decided to rip 4.3%, and stocks decided to rally hard. We did get a bit of a mid day selloff when the fed’s Dudley said that inflation doesn’t matter tp to the fed and a rte increase is still possible this year. The bulls though, bought the dip and we ended up closing on the highs. As a result we caught a stop on UVXY.

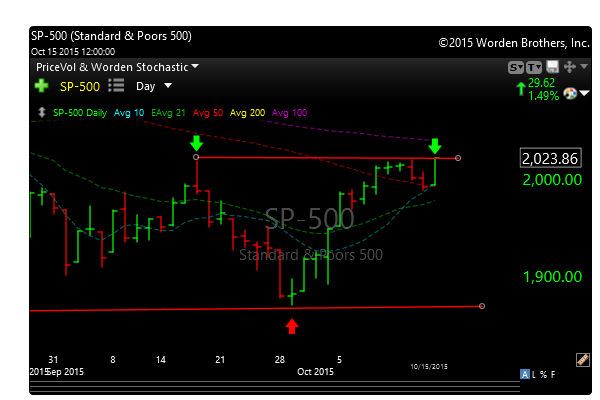

2020 was resistance on the SPX but it managed a close at 2023. The bulls are in control for now, so the pressure is on them to hold the line. We could be one bad earnings report from a selloff. That’s how it goes during earnings season.

See you in the morning.

Go Mets!!