Trading ran at a snail’s pace today and posted the lowest volume since June 12. Crude had a rough day and started falling off hard in the premarket. Down about 5%. Oil service (OIH) was down over 3%. Bottom line, we’re still drowning n black gold and this will not help the energy companies that will be reporting this quarter. You just have to wonder how much of it is already in the bag though.

Earnings will start to come fast and furious now and investors are likely to focus on how corporations were either hurt or helped by the stronger dollar and lower oil prices.

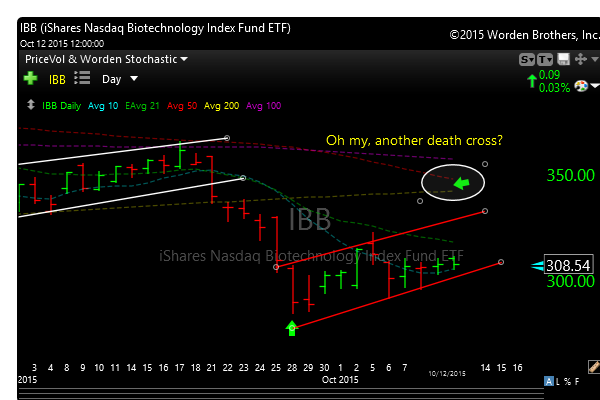

Biotech remains interesting, but paralyzed here. There’s also a possible death cross brewing whereby the 50 day moving average may be crossing down through the 200 day moving average. Not there yet, but it does bear watching.

The market is right at resistance and cant get break above it, so the market is obviously waiting on color from earnings until it makes its next move.

Nothing triggered today, so I’m just sitting tight for now.

See you in the morning.