I Ask A Favor

This market has been a train wreck and people are getting thrown into the wood-chipper right and left. If you fine folks have friends that are in said wood-chipper I would appreciate you telling them about the Upsidetrader site and encouraging them to join us. I think we have navigated this process well and would greatly appreciate the referrals. I think over time they will thank you, so send them a link to join today. Thanks in advance. Your humble leader.

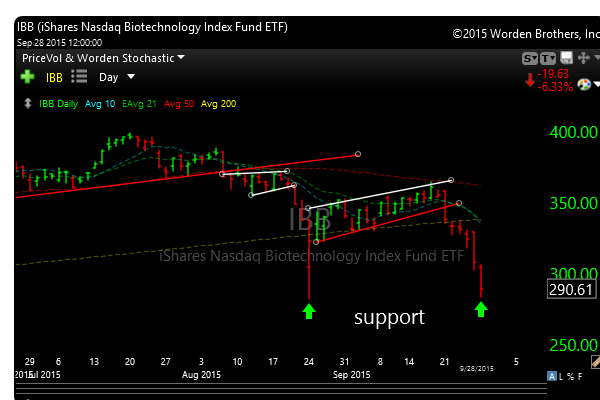

Now back to business. Biotech continued to get throttled today as it was down over 6%. Is it bottoming? I am looking at a few things to answer that question.

#1 Friday was all time record volume for IBB. But today broke Fridays volume record. So you have to ask is this capitulation? I really don’t know yet, but it bears watching.

#2 I always tell you that I like to see the RSI’s (relative strength index) under 30 for me to think something is really oversold. Well it closed today with a reading of 25. So maybe a countertrend rally could be coming, we’ll just have to watch.

#3 It did manage to hold some lateral support today on the daily chart. It came within a dollar today of that Aug. 26 low when the market kind of crashed.

Bottom line, still no rush.

The market was an equal opportunity seller today and really nothing was spared. Materials and commodities of all types were crushed and they just cant seem to find bid yet anywhere.

Energy (XLE) dropped another 4%!!!!!!! UUUUUUUUgly Although energy stocks are getting smoked its interesting to me that crude itself hasn’t broken lower again. Maybe it will soon.

I took some profits today, not because I don’t think the market can go lower, but because we have had semi gargantuan returns over a short span, so as I like to always say, feed the ducks when they’re quackin’.

Here were today’s trades. I also added SOXS long today, SOXS is an etf that shorts the semiconductor space or the SMH. They look vulnerable.

Please remember to check the P&L tab every night so you can stay updated on any stop changes etc….

See you in the morning.

P.S. As there have been so many new subscribers over the last couple of months, please remember that you can email me anytime if you have any questions or suggestions.