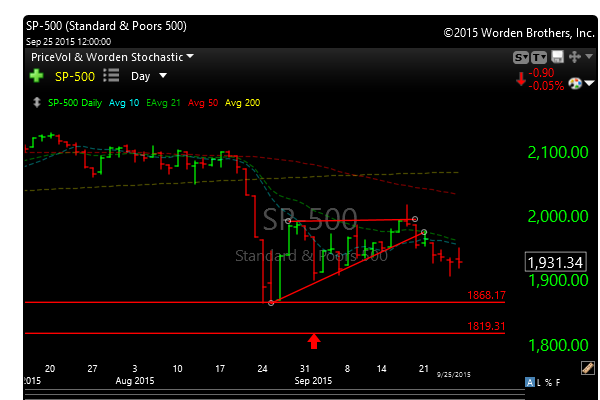

I have talked about that ugly bearish wedge above for weeks now. As I’ve said, that particular pattern rarely (if ever) resolves higher. It seems to always validate lower. Hence the bearish nature of the pattern.

The pattern on the NASDAQ and Russel were identical and they also broke their wedges lower too.

Many blame Yellen for this crappy tape action, others blame China, and lets not forget Europe and the emerging markets. I like to call them the submerging markets.

But what many aren’t talking about at all, and they should be, is earnings. Especially since they start again in full swing in a couple of weeks, What they aren’t addressing at all, is that we haven’t had three quarters of negative revenue growth since 2009; we haven’t had four quarters since the financial crisis.

Well the third quarter is expected to come in down about 3-4%. Ugly. Who knows what the fourth quarter will bring? This will be the big story for the remainder of the year in my humble opinion.

We had a great week in the market, led by short positions in the Dow Jones and Russell 2000 as well as select shorts in CEB, DECK, FOSL and others.

We are overdue for a snap back, but the trend is now down and we aren’t that oversold, so rallies should be sold or shorted until things change.

We still managed some long side victories in:

ITEK +8.2%

MDVN +7.2%

UVXY +12.0%

WTW +4.0%

No losses were reported last week.

Now is a great time to finally become a member, so come join us.

Monthly subscriptions here for $59

Or, be really smart and save a boatload by taking an annual subscription here

Good trading.

Joe