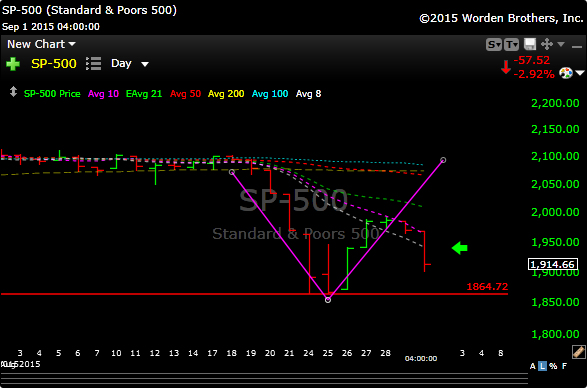

Alas, the V recovery is a thing of the past. Sellers came out of the woodwork today, empowering the bears again and giving the bulls ulcers.

As I look at the charts on the indexes, it looks like they want to go down and maybe retest last week’s lows. I didn’t get a chance to check in on the volumes today, but it was clearly another day where they threw the baby out with the bathwater.

As I said last night it wouldn’t surprise me to see this thing rollover again, and it did. It happens without warning too, which can be a little scary. The fundamentals are built on sand right now and uncertainty rules the roost. We know how much the market hates uncertainty.

The indexes closed down almost 3% today and that is nothing to sneeze at. These moves seem to becoming routine lately and may continue for a while.

I added SRTY long at the end of the day today. Its the etf that gets you short the Russell, I like it better than TZA. Obviously I am betting on a bit of a follow though lower in the Russell.

Have a great night and I’ll see you in the morning.