Kind of how many of us felt this last couple of weeks ^^

Stocks soared for the second day in a row, with the Dow 30 erasing its losses for the week, as renewed optimism about the U.S. economy eased concerns about the pace of global growth.

Even commodities joined the party as oil prices soared more than 10% to their biggest percentage gain in six years amid a surge in commodities. Part of the surge in crude was because Venezuela called an emergency meeting of OPEC as their country is tubing lower because of cheaper oil prices.

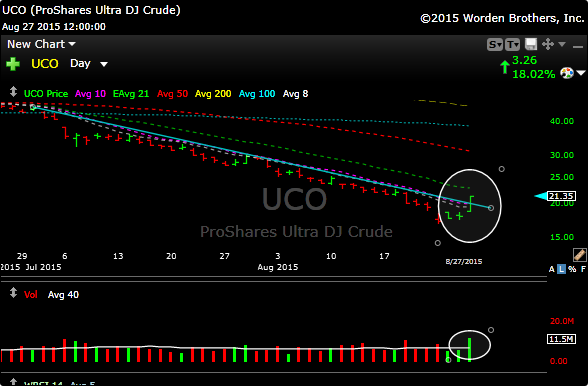

I added UCO after the market closed not so much because of the Venezuela news but because it technically may have put in a short term bottom.

As you can see below, the downtrend line (light blue) was broken to the upside on substantial volume. One of my favorite patterns. I’m rooting for $30 oil but the chart is interesting for a trade.

Even coal got bought today. As a result we were stopped on the WLB short and I covered another 1/4 of the CNX short for a +35% return. I will leave on the balance of CNX you are following the trade at home.

I also took a bunch of solid profits today, so please check the P&L tab on this blog to stay updated if you are following at home.

Correction or Bear Market?

From my perch we saw a healthy 10% correction. Bear markets are defined by a pullback of 20% or greater. Some global markets are in bear territory right now, but not the U.S.. At least not yet.

There will be a time to short, and this site will probably be one one the few (if not only site) that will make you money when the market does lose its bowels. The market cuts both ways. We have to be VERY careful here and I will be watching resistance levels closely for a time to bail out.

Lets see, I traded through crashes 1987, 2000, 2008-2009, the flash crash and this recent little beauty. The signs are usually the same, but by the time people accept the reality (the majority doesn’t, its human nature), its usually way too late. Hopefully I will help you avoid that mess in a big way.

Signing off for now, and I’ll see you in the morning.