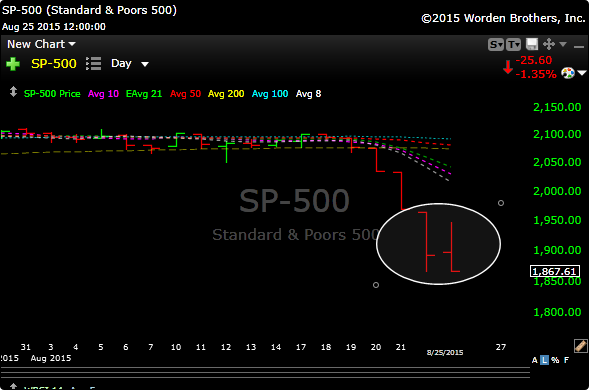

The markets closed on their lows today after a strong open. All the indexes closed on their lows and as you can see above, the SPX closed 60 cents above yesterdays intraday low.

It was a very disappointing turnaround Tuesday and it was bearish action.

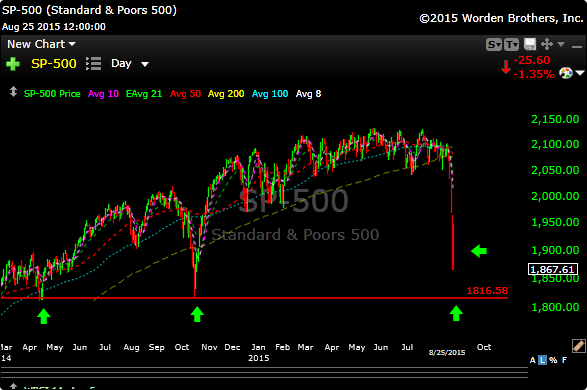

The market is trying to grind out a bottom right now so when rallies happen they get sold because traders are worried about the retest and lower prices.

Today we went all the way back down and retested yesterdays lows, so maybe the rally starts tomorrow. We are back to being way oversold after giving up today’s rally. That does not mean a rally is guaranteed.

The level I like best to get aggressive would be a retest of the Oct 2014 lows, say around 1815-18.25. To me that would be a great flush, it would clear things out and really dry up the sellers. If that didn’t hold, then the level we are looking at is the 1750 zone.

Try not to lose faith. Keep in mind that we have seen 5-6% pullbacks routinely, but we haven’t seen a 10% correction in a while. Now we have, and markets get bipolar. The intraday moves that you will be seeing on a going forward basis will probably be extreme.

The best thing is to trade (if you have to at all) at 1/4 your normal size in a particular idea, and keep your stops tight. The key is to stay whole so you can play the mega rally when it does come.

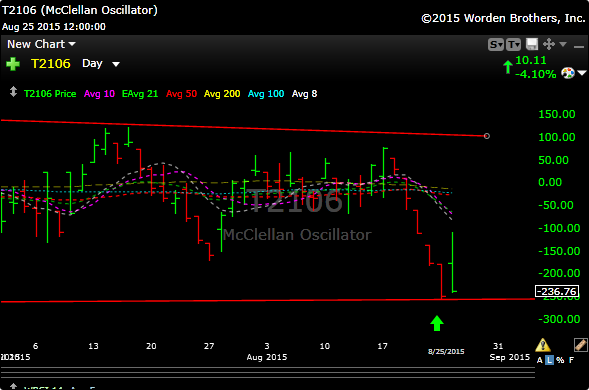

My favorite overbought/oversold indicator, the McClellan Oscillator, flashed deeply oversold at the close yesterday, and true to form the market rallied at the open. BUT, when the market rolled over today, McClellan went right back down to close near yesterdays lows. So, bottom line, we are oversold again. Here is look below.

Its still treacherous out there guys, so play small and play smart.

See you in the morning.