Due to my annual summer flu I am unable to bark out a video today as I don’t have a voice. Friday’s tepid move higher followed several days of sharp rises and falls in the stock market. On Monday, stocks climbed sharply, boosted by the largest one-day gain in oil prices in a month and the announcement of what would be Berkshire Hathaway biggest takeover ever. But the following session U.S. markets erased most of Monday’s gains after China put its currency in the woodchipper. The devaluation stoked investor concerns about the country’s slowing growth, a fear that persisted in early trading on Wednesday.

All the back-and-forth action has left major indexes only slightly up for the week. The Dow added 0.6% and the S&P has advanced 0.7% this week, through Friday’s close. The Nasdaq Composite climbed 0.1%.

Its been a pretty good year for individual stocks selection, actually one of the best that I can remember, but at the end of the day markets are essentially flat this year.

Energy, materials and metals have been horrendous this year. Industrial stocks have done nothing and now biotech is starting to show some cracks in the armor. Some technology here still looks decent though, but again, individual selection.

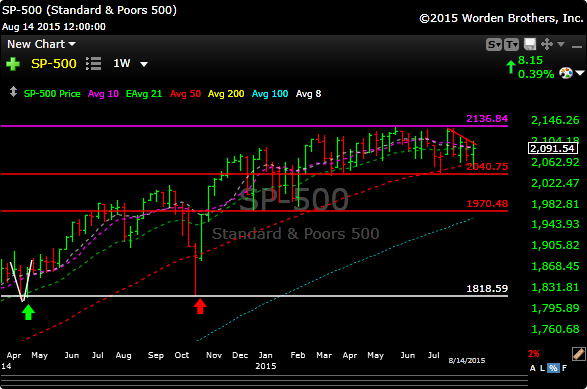

Its not surprising that the charts look anemic on the indices because they really haven’t done much.

The best thing to do, and we try to to it, is to trade the ranges. Basically buy red and sell green. This has worked for a long time now, some day it wont, but for now I think we are fine unless things change in a big way on the economic front.

Basically I would welcome a bigger flusher lower, maybe 10% down, this way we can stop monkeying around and get back to buying things at better prices and with much more confidence.

As a result, I’m not seeing much that gets me particularly excited right here and I like to see where the market tempo takes us first this week.

See you in the morning.