The sellers were in charge today and eight of the ten major sectors were in the red. As you know from the midday update, media stocks got slaughtered and that helped lead the market lower.

In other earnings of note, Tesla tumbled 8.9% after lowered delivery guidance overshadowed better than expected results for the past quarter. Tesla’s loss contributed to the underperformance in the Nasdaq.

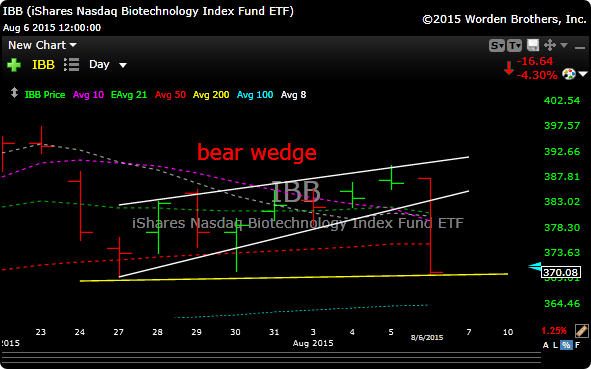

Biotech(IBB) was really weak and lost $16.64 or 4.3%. This is one of the worst days for the sector in quite a while and it is the “risk on” group.

IBB has a few issues right now. As you can see in the chart below its lost its 50 day moving average (red dotted line), it also snapped lower from its bearish wedge (white lines) AND its sitting on important lateral support (yellow line). I try to show you these chart breakdowns so you guys can learn patterns and pattern recognition. Remember…..patterns repeat.

I trimmed more today and I want to let this play out before we put more money on the table. Cash is a good feeling when things get goofy.

The market could react substantially tomorrow based on how Wall St. interprets the jobs data.

See you in the morning.