U.S. stocks fell Monday, dragged down by steepening declines in the price of oil. Monday’s selloff, which accelerated as the day went on, was sparked by ominous signs on the demand side that suggest the global economy may not ramp up enough to absorb all the oil in production.

Part of the reason for the decline was data showing a gauge of Chinese factory-floor activity slumped to a two-year low.

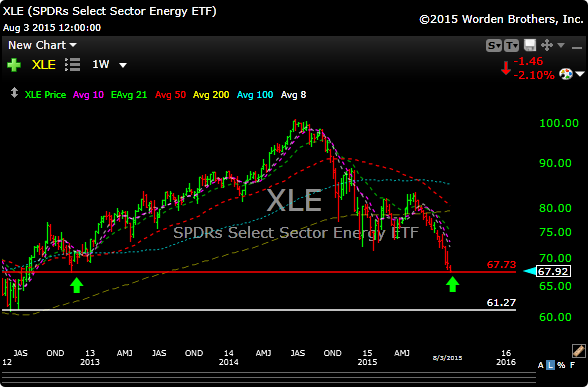

Right now the energy eft XLE is on critical support at the red line. That is a weekly chart below. If that should break, then I see a potential move down to the low 60’s would be June 2012 support. Not pretty.

The 2 new additions from last night, ACAD & JAZZ, didn’t trigger today, but they look very bullish and maybe they just need a little help from the market.

See you in the morning.