Investors are looking to earnings reports from U.S. companies to anchor a stock market that has been tossed around by the crisis in Greece and the prospect of higher interest rates. Earnings season kicks off this week s AA reports. The bar on earnings is so low this quarter it wont take much to beat.

Greece voted NO and frankly I still don’t really know how the market will react tomorrow. A deep sell off would be welcome, so we can get that part of it over with and then start looking at sensible entries. Right now its a mess and very difficult to find solid footing.

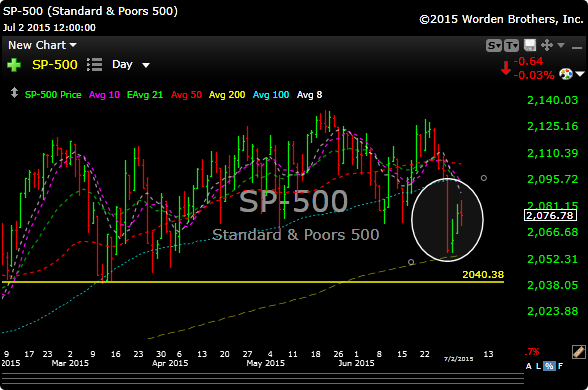

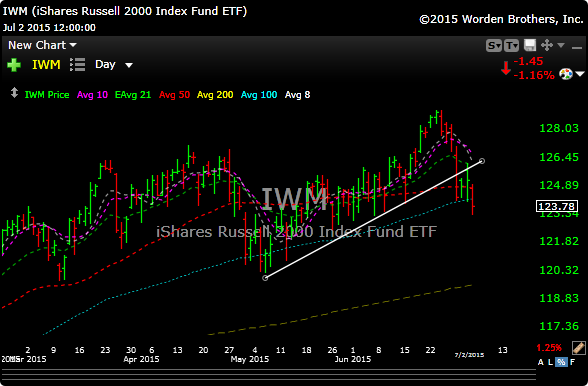

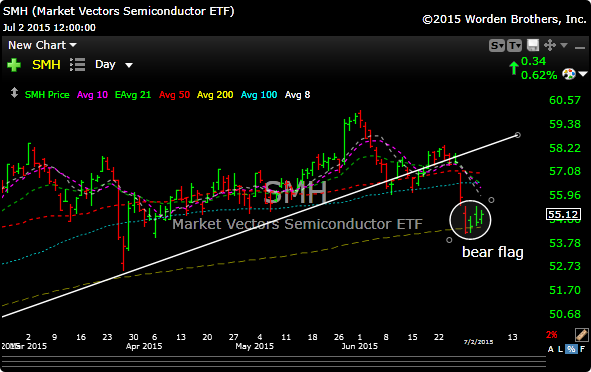

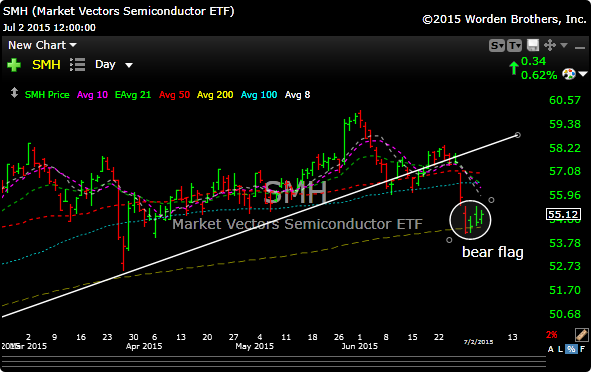

Lets take a quick look at the charts of the main indexes. They are all bearish.

The NASDAQ (QQQ ) is clearly sporting a bear flag. This is a bearish pattern that usually portends lower prices, but depending how Greece gets spun, maybe it can correct itself.

The SPX has a very clear bear flag right at 200 day moving average support

DOW 30 Bear flag right at 200 day moving average.

The Russel 2000 (IWM) has snapped it uptrend and now needs to regroup and get back above declining moving averages.

Semiconductors (SMH), which are a big part of the whole risk on category is in big trouble. It’s oversold, but it can stay oversold. Sitting on 200 day moving with a bear flag.

Keep in mind that their is a mammoth head and shoulder pattern on INTC, so if INTC decides to break lower, so will SMH.

INTC

Lets talk about the open. It will be down, Right now here is a look at the futures as of 6:40 est. As you know, my first reaction to down opens is not to panic, actually I like to start nibbling long and I am not a seller.

This is the “event” that everyone has been waiting for, so I would imagine at some point Monday or Tuesday, calmer heads will prevail.

I shall see you fine people in the morning. Try and hop on the chat room if you are able.

Joe