The major averages ended the Tuesday session near their flat lines with the S&P 500 registering a slight gain (+0.04%) to snap its three-day skid while the Nasdaq Composite (-0.2%) settled in the red.

The S&P could not overtake its 100-day moving average (2,085), settling below that mark for the second consecutive day. Interestingly, this was the first time that the index registered back-to-back closes below the 100-day average since late October.

The indexes slumped at the start with investor sentiment pressured by the continued lack of progress between Greece and its creditors. The ongoing uncertainty weighed on European markets, but they were able to climb off their lows into the close. Meanwhile, U.S. stocks hit their lows not long before Europe closed for the day before returning to their flat lines.

Biotech traded lower today as IBB was down a little over 1%. REGN was halted all day pending an FDA decision. It got the green light after the close and traded lower by about $15. Go figure. So far its a sell the news event, but we’ll see how the market really feels about it tomorrow. As a result, IBB is trading slightly lower in the after market. REGN is the 5th largest component of IBB.

Most sectors looks pretty miserable right now, but REIT’s (IYR) and utilities (XLU) are really getting hammered as rates firm up.

I added QLYS as a short today. This is a high probability pattern to the downside, but like everything else, it will need the market to cooperate to a degree.

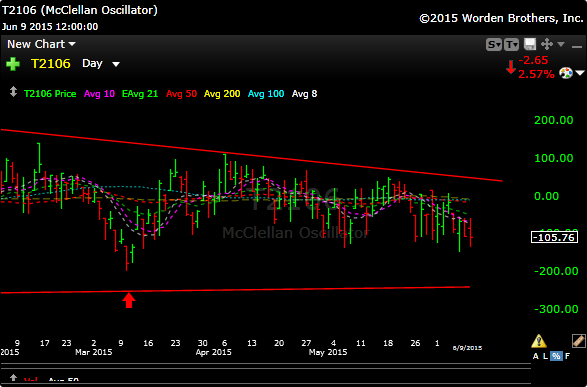

The market continues its boring drift. The McClellan Oscillator which is my favorite overbought/oversold indicator is neutral and closed at -105. You know I like to see it tick down closer to -200 before I go “all in” on the long side.

Hope you had a profitable day and I’ll see you in the morning.