This maddening sideways chop continues and the best “risk on” sector, biotech, looks heavy and tired. The leaders in this space are heavy, AMGN has a bearish head and shoulder pattern going on and CELG and BIIB just cant stop stepping on their feet. GILD acts the best of the big four biotechs. The other biggie, REGN, continues to hang on so far.

Am I being too critical of my favorite group? Am I spoiled and upset that my stocks haven’t been running $5 to $10 a day anymore? Do I have a sick feeling that biotech (IBB) is ready for a 10-15% correction? Maybe.

In past periods of sideways, sluggish action in this group I have always remained bullish. I am still bullish as all get out on a long term basis for many of these stocks, but short term, well, not so much.

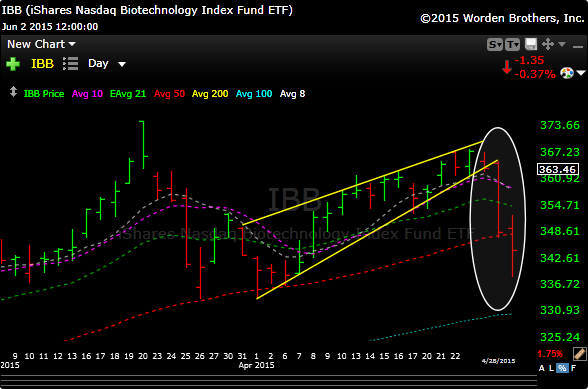

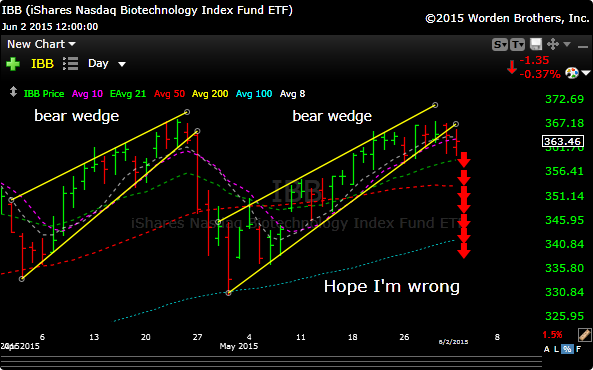

To me, charts tell the story, so it helps me analyze things more clearly when these lulls happen. Right now, if you just showed me the chart of IBB without the ticker symbol, I’d tell you to short the group for a trade. Right now, I see the second of two bear wedges on the daily chart. Here is what happened when this pattern snapped back in late April. End of the world? No. But IBB dropped 28 points in two days. A classic bear wedge (yellow lines) led to that sell off. Chart below.

Now look at the second wedge. Look familiar? Look, I may be wrong, but as a technician I have to respect this pattern. History repeats and so do chart patterns. If it does roll over, I don’t think it would be the end of the rally, but I’d like to be out of the way of traffic if it does.

In case I’m right, I added BIS today. This is the etf that is short IBB. I have a reasonably tight stop.

I started the new June P&L, so if you want to check in its ready for your perusal.

Have a great night and I’ll see you in the morning.