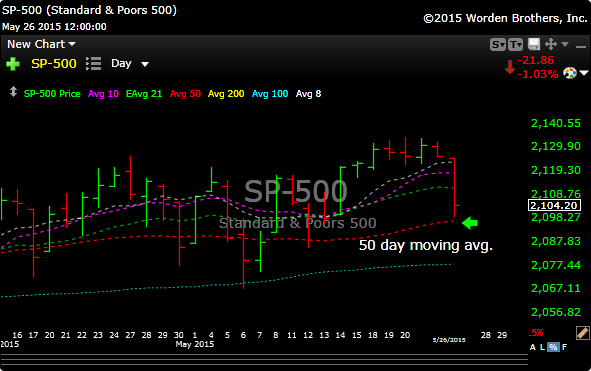

It wasn’t a good start to the shortened week for the stock market. Each of the major indices fell at least 1.0% as buyers proved to be a reluctant bunch. That weakness started early and it continued for most of the day, which saw the S&P flirt with testing support at its 50-day simple moving average (2096). The fact that the S&P 500 didn’t pierce that level was perhaps the lone bright spot in Tuesday’s action, which saw all ten sectors lose ground and all 30 Dow components end with a loss.

When I look at the market and try to gauge the possibility of a deeper correction, I always look at the most “risk on” sectors. One is biotech and the other is solar.

The latter has been acting horribly over the last few weeks but was down less than a percent on day when it really could have been taken to the woodshed. (TAN)

Biotech, (we watch IBB), was down less than a percent today. So it could have been much worse. This doesn’t mean we are home free, it could be the start of something; we’ll just have to see.

The U.S. Dollar ripped today and that put big pressure on crude prices and gold/miners.

Both gold GLD and GDX are working some very ugly head and shoulder patterns which are bearish.

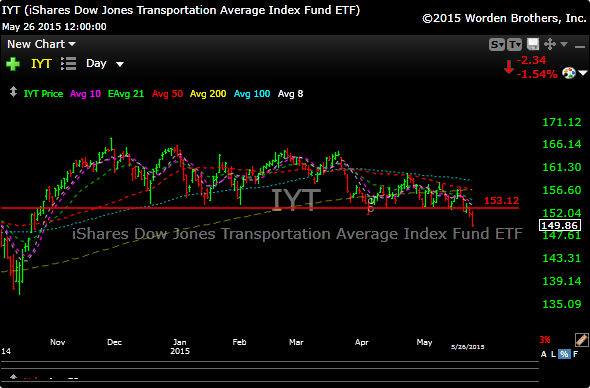

The one group that is really horrible though is the transport sector (IYT) . Just cant get out of its own way and the airline group isn’t helping this group. It has broken all of its key moving averages and looks lower.

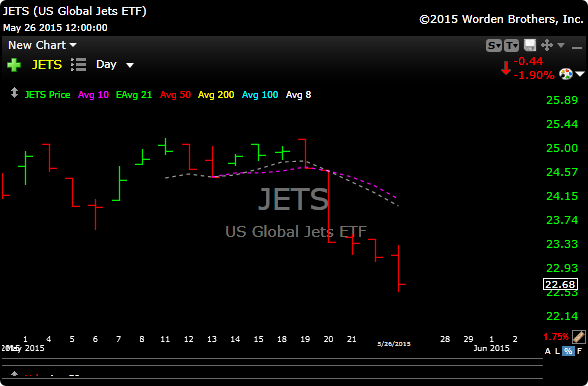

How about this new airline etf? JETS….ouch

See you in the morning.