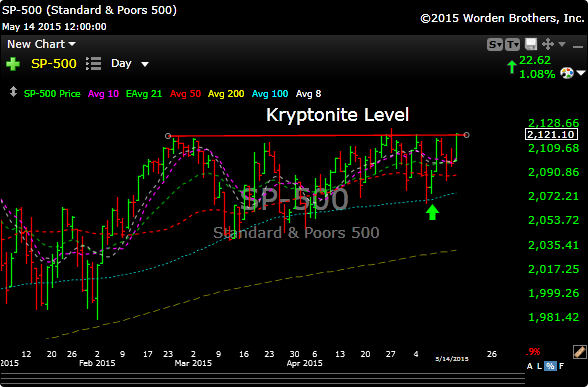

The major averages registered solid gains on Thursday with the S&P climbing 1.1%. The index settled at a fresh record high of 2121.10 while the Nasdaq (+1.4%) outperformed. However, biotechnology, contributed to the strength in the Nasdaq. To that point, iShares ETF (IBB 355.59, +4.74) gained 1.4% and stayed above its 50-day moving average (350.53) now for the fifth day running.

Three of our current bio holdings did well as OPK added another 6.5% to yesterdays pop. It closed at a 15 year high (dating back to the tech bubble burst in 2000), by a couple of pennies. REGN finally got off the mat and added $14 or 3%, NFLX added 7 points and BIIB popped $4.50. Our only short, FOSL, caught a dead cat bounce on light volume.

The Russell 2000 had a decent day an closed right t its 50 day moving average. The Dow finds itself very close to new all time highs. What a difference a day makes huh?

Once again, participation was relatively light with roughly 700 million shares changing hands at the NYSE floor.So maybe the summer doldrums are starting early. That doesn’t mean the market cant walk higher.

I didn’t make any changes to the P&L today.

See you in the morning. hey, it’s Friday.