Well, we had another retreat as we approached what I have coined the ‘kryptonite level”. Lets call it the 2120 area on the SPX. This “poke & pull” been going on since the end of February. Market rates spiked again with 10-yr yield at highs for the year and the 30-yr bond yield above 3.00%.

The Dow Jones (-0.5%), Nasdaq (-0.2%), and S&P 500 (-0.5%) all ended the day in red figures. The Russell 2000 (+0.2%) finished off its highs for the day, but still managed to close the session higher.

There was a particularly weak showing from the energy sector (-2.1%), which failed to get on track after news reports indicated OPEC expects oil prices to stay below $100 for the next decade.

By and large, the lack of follow through after testing the all-time closing high took the wind out of the market early and then the market trended steadily lower as long-term rates crept steadily higher.

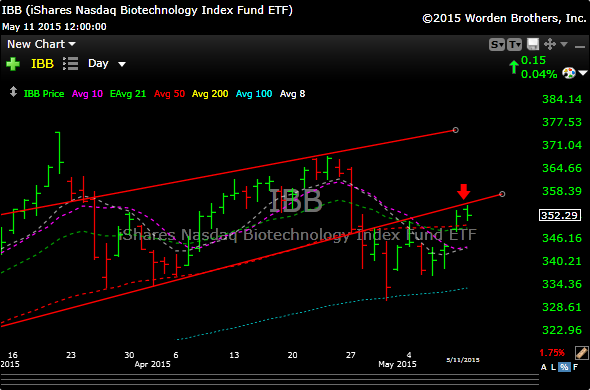

The biotech etf IBB is getting interesting. It has closed back above its 20 and 50 day moving averages the last 2 days, but is at the underside of its uptrend line. (see red line). This can be a fail spot, so lets watch closely.

We had three triggers from last night: NFLX, REGN and ADRO.

FOSL ans SWHC did not trigger.

See you in the morning.