The stock market snapped its two-day skid with a Thursday advance that lifted the S&P 500 (+0.4%) into the neighborhood of its 50-day moving average (2,089).

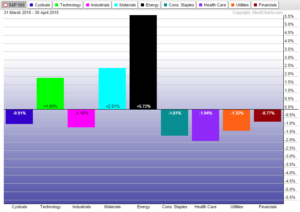

Sector rotation is in full swing. Below we can see how the various sectors fared in the month of April. Energy was the clear winner along with a bump in materials. Money left healthcare/biotech.

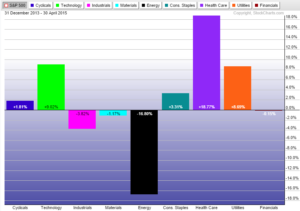

But a YTD view still shows healthcare as #1 and energy the worst. It does bare watching though. One month doesnt have to change a trend, but it is something to watch.

The market is messy now. We are seeing up one day, down the next type action. We’ve seen this before and its always the sign of an indecisive market.

Why are markets a little confused?

In sum, oil prices are up big despite inventories being at an 80-year high; European bond yields are up big despite the ECB’s asset purchase program; the euro is up big despite everyone thinking that it was destined to hit parity with the dollar; the biotech stocks are down big in recent action despite being a must-own group; Apple is down big after putting up impressive first quarter earnings results; the transports are down big despite lower fuel prices and the thinking economic growth is poised to accelerate.

Go figure right?

Anyway, as I said the other night, let the market do what it does right now and let it come to you.

See you in the morning.