The major averages ended April on a lower note, but managed to escape with monthly gains. The S&P 500 lost 1.0% and narrowed its April gain to 0.9% while the Nasdaq (-1.6%) underperformed today and ended the month (+0.8%) just behind the S&P.

The tech sector contributed to the underperformance of the Nasdaq, but the index also faced significant weakness in the biotech group. The Biotechnology ETF (IBB 333.66, -11.15) lost 3.2% and settled just above its 100-day moving average (331.05). The ETF dropped 2.8% in Apri, but is now down about 11% from its all time intraday high in just the last five weeks.

This market looks very rough in here, so lets be careful out there.

The new P&L is up for May and I added a few new names over the last couple of days. The Nasdaq will probably be in trouble until we can get a bottom in the biotechs. There are a lot of moving parts right now, so dont be too aggressive and catching knives is a fools errand. The market will still be here when things settle down, and it will settle down eventually. We’ve seen this movie many times before.

NEW NAMES (on P&L)

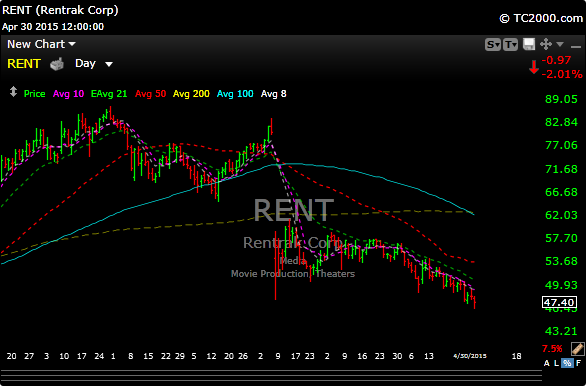

RENT– short

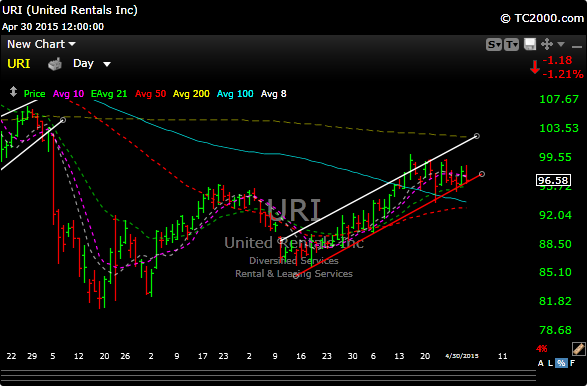

URI– short

DUST -a long but gets you short the miners or GDX.

See you in the morning.