The stock market began the week on an upbeat note with the S&P 500 (+0.9%) erasing the bulk of its decline from Friday. The S&P reclaimed its 50-day moving average (2,086) at the start and spent the remainder of the day near its early high while the Dow Jones (+1.2%) and Nasdaq Composite (+1.3%) outperformed.

Global equity markets enjoyed a strong start to the week after China lowered the reserve requirement for all banks to 18.5% from 19.5%. The 100-basis point cut was the largest such move since November 2008 and was implemented in hopes of avoiding a slowdown in China’s economic growth. This I guess made up for China raising margin requirements on stocks Friday and loaning stocks for short sales. The market has a short memory and all was forgiven.

Biotech

CAR-T stocks like KITE, and JUNO got hammered today…BLUE not so much.

KITE released some results and the weakness was due to disappointment in the data lacking the level of efficacy. It is a very early stage result though, and the study was only in six patients. Also the dosage was very low which is routine in the very early stages.

BLUE recovered about 8 points off it day low, but JUNO and KITE went out on the lows. I expect a rebound shortly as these reactions are almost always an overreaction and a knee jerk.

Also keep in mind that the ASCO 2015 conference comes up shortly and there is usually very good action in biotech in front of this event which is the grandaddy of them all. Shorts will probably cover in anticipation in the weeks ahead.

I did take the stop on the remaining position in JUNO ( +$12.50) and I will probably buy it back over the short term.

Neither AGIO or EIGI triggered today. ONCE was stopped.

Our other stocks acted well: AGEN +3%, DISCA +3.5%, UVE +2.2%, BLCM +2.8%, TQQQ +4.4%, CYBR +3.2%, CLDX +4.9%

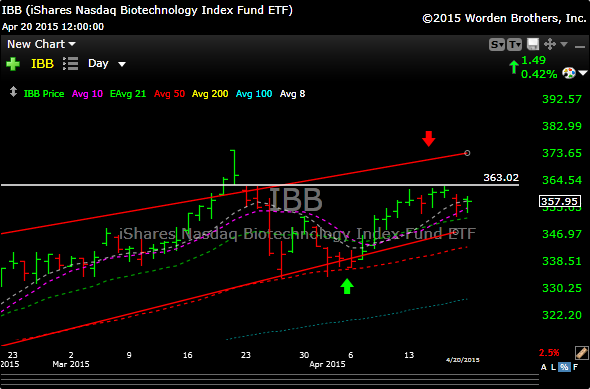

I’m now watching the $363 level on IBB. That level needs to be triggered with volume if the ETF wants to get going again.

I caught some of Fed’s Dudley’s speech today. My takeaway is that rates stay low.

1- “we are still data dependent”………….meaning we aren’t attached to any particular plan.

2- “unemployment is still too high” …………(Fed isn’t stupid, they know this 5.%% rate is smoke and mirrors, I said this months ago and I’m right”

3-“the stronger dollar will reduce GDP bu 1/2%”……the economy is bad.

4-“there is no inflation”

NEW NAME

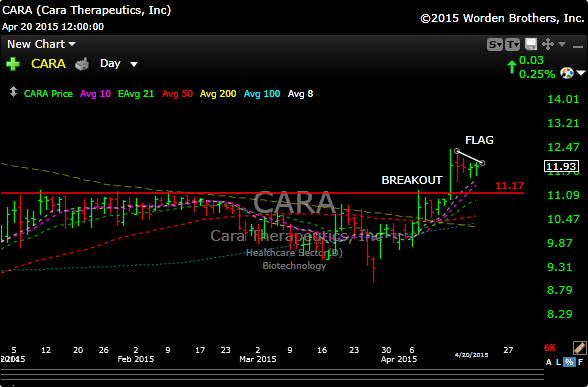

I am adding CARA tonight, its a stock I’ve watched for a year and traded it a few times. Its fairly thin so don’t go crazy.

Anyway, as you can see in the chart below, it broke out of a long base on April 14 on about 15X normal volume. It is now forming a bullish pennant or flag and may be ready for another move up. Buy the 12.25 area

Have a great night and I’ll see you in the morning.