The major averages began the new trading week on a lower note. The S&P pulled back 0.5% after spending the day in a steady retreat from its opening high while the Nasdaq shed 0.2% after showing relative strength throughout the day.

All in all, Monday was very quiet with the S&P spending the day inside a 15-point range. The market did not receive any noteworthy data or earnings, but that will change as the week wears on.

The biotech ETF (IBB) registered its sixth consecutive gain after being up more than 1.0% in the early going. That is bullish because it the most “risk on” sector.

Tomorrow, the March Retail Sales report and March PPI will be released at 8:30 ET while February Business Inventories will be reported at 10:00 ET.

- Nasdaq Composite +5.3% YTD

- Russell 2000 +5.1% YTD

- S&P 500 +1.6% YTD

- Dow Jones Industrial Average +0.9% YTD

I added four new stocks in last night’s video and they all triggered long today: EW, CLDX, BLCM, and MIFI

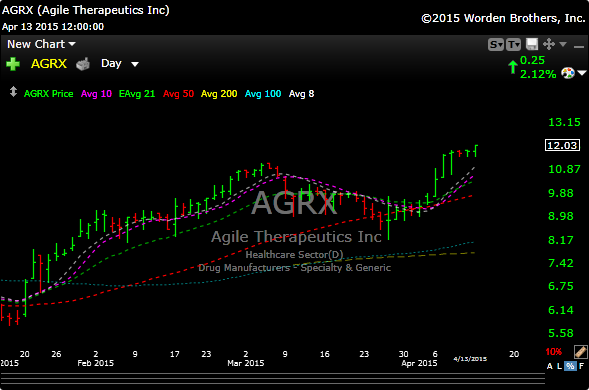

I also added AGRX today during trading hours. Below is a picture of the chart. That flag is bullish, so maybe it can work higher for us.

Two other biotechs that I have my eye on are FOLD & CAPN.

We have a big day for earnings tomorrow. Before the market opens, the following companies will report: JNJ, JPM, WFC

These companies report after the close: CSX and INTC

See you in the morning.