The market registered its third consecutive decline on Wednesday with the S&P ending lower by 1.5%. The benchmark index settled below its 50-day moving average (2,067) while the Nasdaq Composite (-2.0%) underperformed throughout the day.

The S&P 500 hovered near its flat line during the opening hour, but high-beta groups like biotechnology (IBB, XBI), chipmakers (SMH), and transport stocks (IYT) began showing weakness early on and continued their retreat throughout the day. As a result, eight sectors settled in the red with five ending behind the benchmark index. Solar stocks also got crushed as (TAN) was down 4.26%.

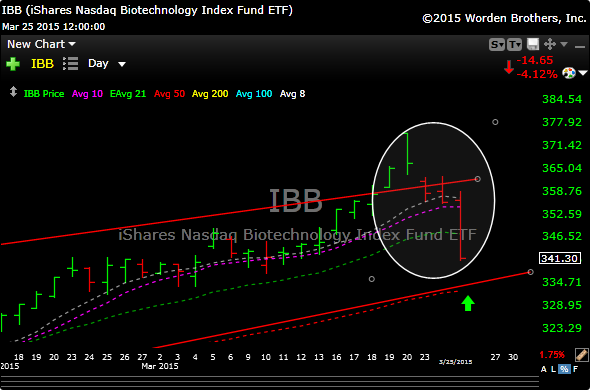

The sharp losses within the tech sector pressured the Nasdaq while biotechnology also weighed on the index. The biotech etf (IBB 341.30, -14.65) slumped 4.1%, extending its week-to-date loss to 6.9%, but down about 8.5% from Friday’s intraday highs. Quite a four day pullback to say the least.

We are in the pre-announcement period, when companies will begin issuing warnings ahead of the earnings season and many investors expect that the first-quarter earnings will be poor.We are discounting that potential outcome now. We’ve seen it before.

The Russell 2000, which has held up quite well, fell apart today and broke 3 moving averages and was down 2.7%. It’s close to the uptrend line. Chart below.

IWM

I’m not sure the selling is over yet. The McClellan Oscillator isn’t that oversold yet and that has been a solid indicator in the recent past. Also, relative strength for the indexes is still in the mid 40’s and I’d like to see readings closer to the low 30’s. Those levels can be hit quickly though, so we could find ourselves oversold in short order. Maybe a matter of a day or two.

Whats interesting is that all the 4 indexes are just about at their uptrend lines. That can be support for us, but if the trend lines break (very important) we could cascade lower. Below are the charts of the indexes (Russell is above). The green arrow is the uptrend line support area.

SPX

QQQ

DOW 30

To give you an idea how violently and quickly biotech has corrected, just look at Fridays high to today’s close for IBB.

Lets keep our eyes on SPX 2040 then 2020 for short term support.

Hang in there and I’ll see you in the morning.