The market had a good day prompted by semi dovish comments by Janet “Aunt Bea” Yellen. Bottom line she isn’t seeing inflation and remains data dependent. Blah Blah Blah. Same story. As a result, yields dropped. (TBT -2,6%).

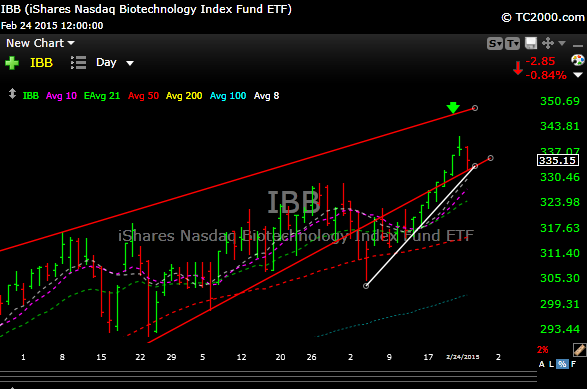

Biotech had a very sloppy day (with the exception of our NDRM) which popped about 10%. Unfortunately ZFGN stopped. As you can see in the chart below, IBB had a pullback day after making all time highs on Monday. However it is still in the bullish channel (red lines) and held its very short term uptrend (white line).

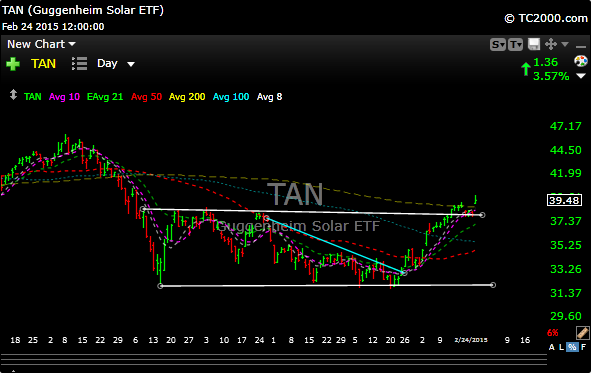

You wonder if the market is pulling one of its sector rotations again as the best groups today were solar and coal. Go figure. Is the rebound in coal for real or just one of the countless head fakes?

KOL– This really doesn’t look bad at all and the BTU chart actually intrigues me a little. Will do some work on this. Some of my worst memories ate attributed to coal though, so not sure how far I will get.

TAN- This solar etf held support back in late January and has ripped 30%. No positions just pointing out the move.

See you in the morning.

Joe