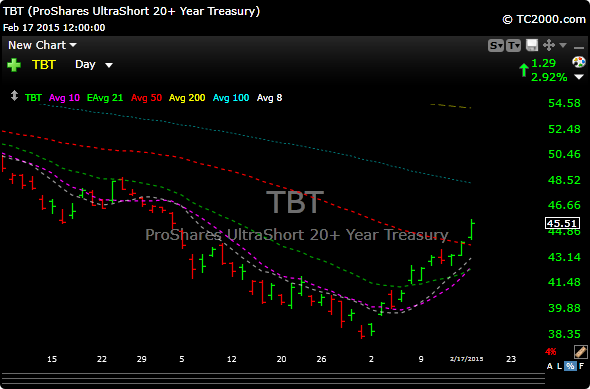

The indexes were marginally green today, but managed to make more highs. The big mover today was interest rates as the 10 year treasury (TNX) was up over 6% to a yield of 2.14. The yield closed at 1.67% just about 2 weeks ago.

As a result the etf TBT broke out through its 50 moving average today. Is this finally the move that everyone has been waiting for? We’ll see.

All four of the new additions from last nights video triggered today: MGNX, EPZM, MYL and ACAD.

IBB acted better , but what was telling today was the action in SBIO, which is the etf for the more smaller to midsize biotech stocks, so maybe money is going to that space now. We’ll watch this.

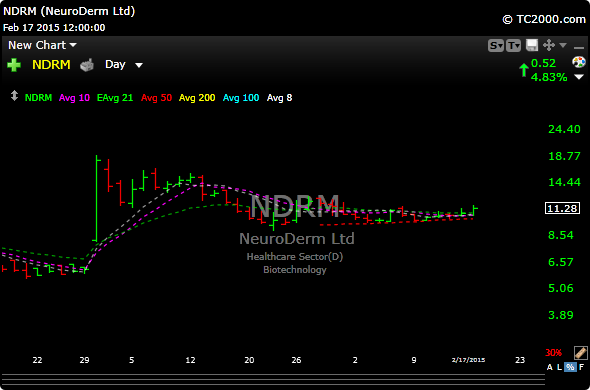

Tonight I am adding one new stock…..NDRM

NDRM gapped up from about $6 to $20 back on Dec.20 off some amazing game changing news on a Parkinson’s disease treatment. It has retraced maybe 50% of the move and has been coiling bullishly ever since. The MACD is looking like it wants to cross positive too. This is a thinner name that averages just about 150,000 shares a day, so play smaller until volume returns.

My buy level is the 11.80 level. See you guys in the morning.

Joe