The markets are following through from yesterdays reversal which is a good thing. All the support levels on the major indexes held and rallied yesterday and today we are seeing a follow through.

The market is being led by the sectors that have been hurt the most. Steel, solar, financials, coal and especially energy is leading the charge.

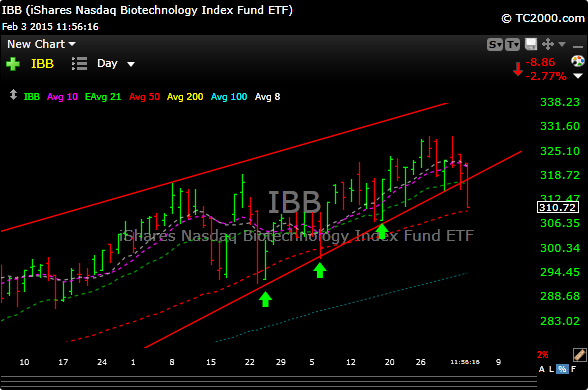

Biotech has been softening up over the last week or so, and the IBB is down about 5.4% since the new highs that were put in last week. As a result, we are seeing some stops.

The IBB has temporarily broken the uptrend line that I have been highlighting for a while. However, the 50 day moving average could show some support. That comes in around 309.86. So far today, we have come within about one dollar of that level.

Biotech is running into some challenges today on a report that the government wants to negotiate Medicare prices with drug companies. We have seen this chatter before (specifically with GILD), but the selling wore off and it ended up being an overreaction and a big buying opportunity. We will see if the same applies.

I will keep you posted.