Yes biotech has outperformed the S&P for years now, and yes some stocks in the group may be stretched. I also respect the market enough not to wax Pollyannish here. There will speed bumps along the way, but this powerful trend is up and it shows no signs of slowing down.

Could $IBB pullback to to 280-290 and still end the year at 360? Absolutely, and in a way you should hope it happens so you can get better entries.

I’ve traded biotech since the 80’s, back then they were working on earaches, now companies like Bluebird ($BLUE) are showing 90% cure rates in child anemia and some say could cure sickle cell anemia { this year?) Don’t get me started on JUNO and KITE. Amazing science.

With these amazing sciences in play now, how long do you think companies like $KITE, $JUNO, and $BLUE will remain public? That’s part of the beauty of this. What short seller wants to make that short bet when a $CELG or an $AMGN could come in and pays double for any of these names.

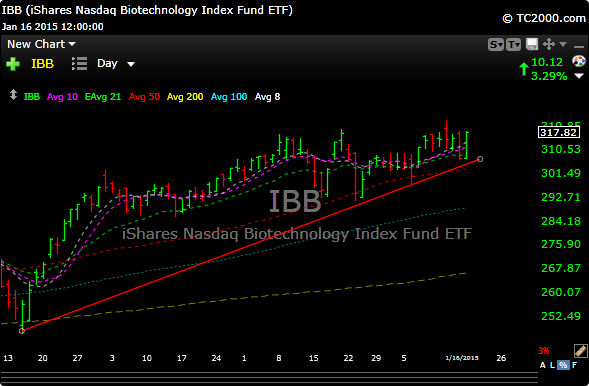

At a few points last week, the $SPX was down about 100 handles from their December intraday highs. IBB managed a solid week, ended higher than where it started, and held its uptrend line.

Don’t get me wrong, this sector will take a waffle iron to the face at some point, and Thursdays action could have been a shot across the bow, so buy the dips in the quality sciences and you should have a great 2105.

If you would like to gain exposure in this sector, Premium subscriptions are available here.

If you would like to see our actual trades for January go here.