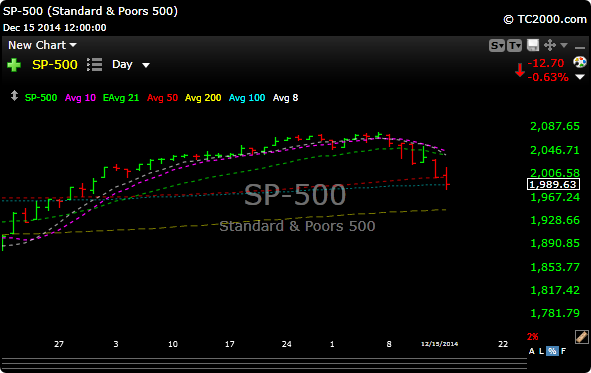

There’s no telling how this current pullback will play out, however, we should take away the fact that this is a a time and place to be more cautious with our trading. Not until the corrective action has run its course and buyers regain control back above the 50-day ma, should our confidence level grow. The S&P held the 100 day moving avg, today , but closed below the 50 day. It will be a good first step for us to get a solid close above the 50 day.

If you watched CNBC today (don’t) or watched the Stocktwits stream there was an incredible amount of noise, mostly negative. Many were opining the end of civilization because crude was trying to break the $55 level. I have news for you, it probably goes lower. If crude going to 50 is a Black Swan, than I will take it. I worry about other things, not crude.

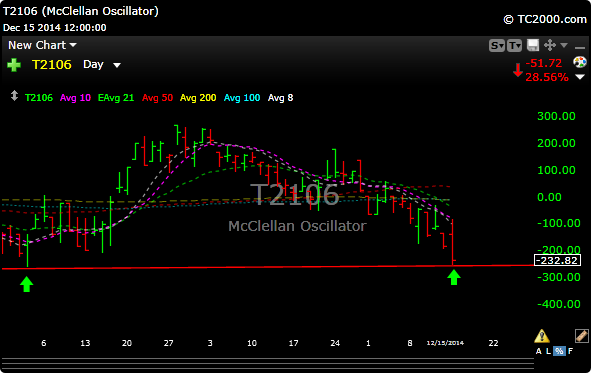

On the positive side, some of the weekly technicals I’m watching held support and the McClellan Oscillator (which has been money in the past) tagged the low reading in October when we bottomed and ripped higher. This is no guarantee that the same will occur, but you have to respect the indicator.