It was a great day for the bulls and the technicals really did continue to improve today. We may be seeing a sharp V bottom reversal because the bounce off the lows has been violent.

The VIX (fear index) has collapsed again and a 10% move down in the VIX (in a day) has, in the past, signaled a bottom. The McClellan Oscillator is also over zero for the first time since early September.

We are a little short term overbought now, but the bulls could in fact keep it this way.

New Potential Buys

Facebook (FB)— Has been charging back since last week and volume is improving. Buy the 76.50-77.50 level. Target 80-85

MDVN – Was a nice winner for us a month or so back and the pullback looks good for entry. Buy the 94.50- 96 range. Targets 105-110.

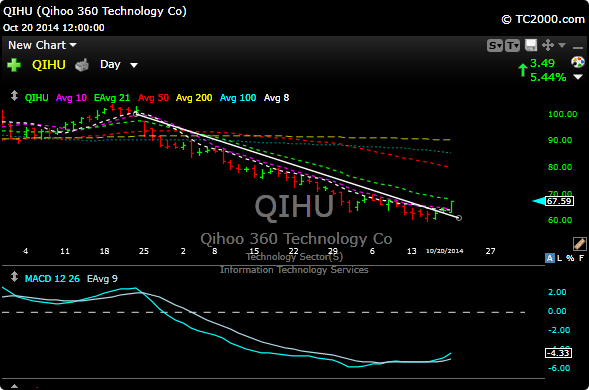

QIHU- It’s almost unfair how some stocks have been crucified. QIHU peaked and rolled over about 2 weeks before the Chine market (FXI) pulled back. Buy the 67.50-68.5 range. MACD has crossed positive, way oversold and volume improving. Targets 73-76

Portfolio Update

We are down to very few names due to the correction. We now rebuild with the newer names. Actually the only remaining name is WFM. The new stocks that were added last night haven’t triggered yet, but AKRX came within pennies of triggering. ACHN put in an inside day and is on our radar.

Upside’s Commentary

The market rose today, as gains in Apple (AAPL) and strong earnings from Hasbro (HAS) outweighed a drop in IBM, which reported weak 3Q results and withdrew its guidance. The Dow was up 19, or 0.1%, to 16,400. The Nasdaq gained 58, or 1.4%, to 4,316, while the S&P 500 advanced 17, or 0.9%, to 1,904. Advancing issues outnumbered decliners by a nearly 3-to-1 ratio on the NYSE, where volume was light.

Today launched the 27th anniversary week of the 1987 “Black Monday” crash. Ah, I remember it well, sitting at my desk at Lehman Brothers. It was wild stuff and I watched a market the likes of which I had not even remotely seen before. Brokers and clients were destroyed and we watched. If clients couldn’t or wouldn’t meet margin calls we were told to sell. The firm was petrified of client funds going into negative equity.

I also remember that day well because it was also the day of the biggest IPO at that time. It was the BP British Petroleum IPO. We c0- manged the deal with Morgan Stanley and both firms could have walked away and put it on the back burner. They didn’t, they thought it would stir more fear. They stepped up, and in true old style fashion bit the bullet and did the deal. It was impressive and it took balls.

Evidently a guy named Lew, who was a broker, was personally on the wrong side of a sizable OEX option trade. He went home about three hours into the crash and ate a jar of Valium in his bathtub. True Roman style huh? He made a call for help with his last breaths and actually was saved. He lived two blocks away from 55 Water St. He wrote the buy ticket wrong. I knew Lew a little bit.

It was actually the greatest learning experience in my life, not necessarily the dollars and cents of it, but just watching how people react in crisis. Lehman could not have been better to us back then, real pros, gave us whatever we needed. I learned a lot.

That crash was the big one for me. The 2000 tech bubble paled in comparison, to me anyway, and the flash crash was not a biggie to me. I actually made good money buying things that day at the depths of the algo apocalypse. The 2008 crash was bad, but it happened in slow motion. 1987 was fast and it was over with. I was younger then and impressionable, probably why it was so impactful to me.

Anyway, the takeaway is that the market always heals itself.

What we saw last week was really nothing in the grand scheme of things.

See you in the morning.