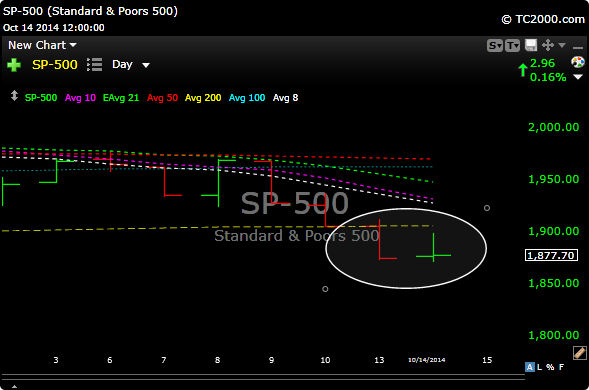

If the market had opened way down today and closed where it did I’d feel better. Instead, the market opened up, and like yesterday, pretty much gave it all back. Bearish action, but we do seem to be trying to carve a bottom. I don’t want to get too technical here, lets just say there are still more sellers than buyers for now. When it was all said and done we only closed a few points higher than yesterday. We are now down about 6.7% from the intraday high that was put in on Sept. 19.

I’d feel better about getting long if I could get a reading on McClellan at around -250-300

Right now there is big pressure on Draghi to implement full fledged QE. Germany’s Merkel is fighting it, should she eventually acquiesce, that could be very bullish for the markets. Europe still looms large and acts as a wet blanket on things right now. Their current “QE Lite” program isn’t cutting the mustard right now and the market knows it.

Below is one of the “long” European etf’s. Basically in free fall.

There are a lot of moving geopolitical parts right now and the market is in the process of processing and discounting all of it.

Nothing new in the new idea camp tonight. I’m making a list and checking it thrice though.

See you in the morning.