Europe has done a 180 over the last two months, the euro has crashed forcing the U.S. dollar to make a massive run to the upside. As a result of the ripping greenback, commodities of all kinds, especially energy, are getting smashed.

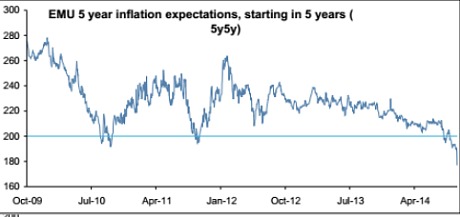

A key gauge of deflation risk in Europe is flashing red, dropping to record lows on fears of fresh recession and lack of decisive action by the European Central Bank.

It feels like deja vu all over again as those ass-hat rating agencies have once again crawled out of their holes and are starting to downgrade countries again. France got downgraded and kicked to garbage on Friday. Italy is looking for a Beretta to put in its mouth. Germany borders on recession? Really? This soon? Thought they were fixed. Guess not.

“The 5-year/5-year forward swap rate monitored closely by traders plummeted beneath 1.77pc on Friday morning as a global growth scare drove European stock markets to a 12-month low.

“This rate is the most important market signal on the planet right now. Everybody is watching the chart, and it has just gone off a cliff,” said Andrew Roberts, credit chief at RBS.”

The markets are now looking for Drahgi to launch full blown QE and not “QE Lite”. The latter isn’t working and Deflation has become THE greatest fear.

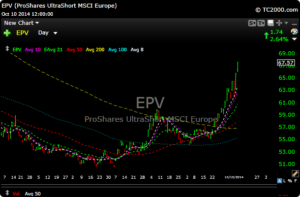

Look at what the short Europe etf has done just since the beginning of September. Individual European etf’s are a mess.

Meanwhile on this side of the pond…………………….

See $XME, the metals and mining etf. It doesn’t get uglier.

$XLB Materials are brutal and broke 200 day ma support hard.

Technology ($XLK) looks like the 200 day moving average may be tagged as soon as Monday.

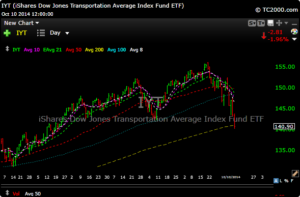

The transports ($IYT) have broken the 200 day, the ebola scare is killing the airlines and worries about global slowing are hurting the rails.

The financials ($XLF) had a nice blip higher in August/September as rates temporarily rose. Now that rates are diving again, financials are dying on the vine. Banks need higher rates to make the spread.

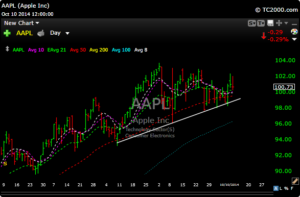

$AAPL int that inspiring, but money may decide to go and hide here for a while.

Meanwhile, could $SPX have closed any closer to its 200 day moving average on Friday?

If you would like to join us for strategy and analysis with more specificity, become a Premium Member here.

Good luck next week. This is where opportunities present themselves.