For the day the SPX/DOW were mixed, and the NDX/NAZ were -1.0%. Bonds gained 7 ticks, Crude rose 55 cents, Gold added $3, and the USD was flat. Tomorrow: PPI at 8:30, Senate testimony from FED director Hunter at 10am, and the FED starts its FOMC meeting. SPX 1973 is our first line of support short term, so lets keep an eye on that.

Sector results were mixed and there were some green sectors, but biotech got hit the hardest.

There is an interesting rotation going on right now and I’ll call it the Alibaba Syndrome. You may have noticed that the DOW and S&P were in good shape today, but the Nazzy and Russell sold off. This tells me that the momentum funds and growth funds are liquidating some momentum names because they are raising liquidity for Alibaba which goes public this week.

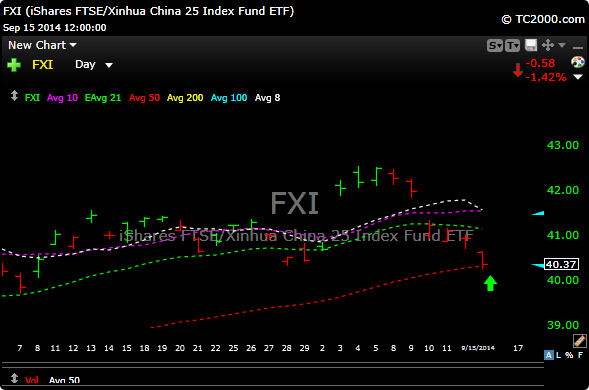

Also notice that China has corrected. I thing the same thing applies there., selling for Alibaba. The FXI has pulled all the way back to its 50 day moving average.

Momentum names like LNKD WDAY, TSLA , NFLX, DATA and YELP got pounded today.

In the “bad news comes in three’s” department, the Russell 2000 managed to break 3 moving averages today. The 50, 100 and 200 day moving averages all were violated.

About 80% of stocks I’m looking at look like shorts right now, but that always happens when the market starts to pull back. Right ow I’m just watching for the most part.

LGF triggered today. Mockingjay

See you in the morning.