For the day the SPX/DOW were -0.20%, and the NDX/NAZ were -0.20%. Bonds gained 5 ticks, Crude rose 75 cents, Gold rallied $7, and the USD was flat.

Short term support is still SPX 1985 and 1973, with resistance at SPX 2005 and 2019.

Tomorrow: Personal income/spending and the PCE at 8:30, the Chicago PMI at 9:45, then Consumer sentiment at 10am.

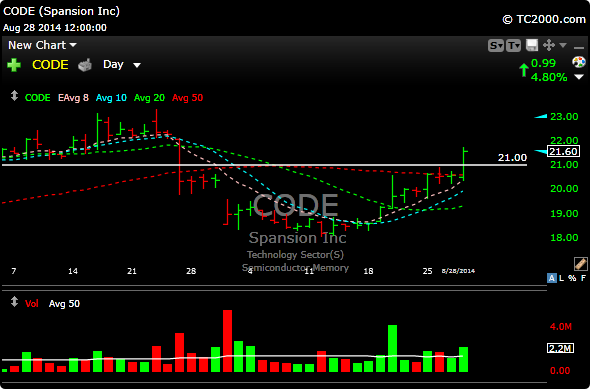

One of the more interesting stocks on our list today was CODE. Over the last week or so the volume has been terrific and there is very active call option action. Note the volume below. Today it took out some lateral resistance and broke out of that saucer like base My next target is around 23.50.

See you in the morning.