For the day the SPX/DOW were +0.30%, and the NDX/NAZ were mixed. Bonds lost 11 ticks, Crude added 55 cents, Gold dropped $4, and the USD was higher. Short term support is at 1973 and SPX 1964, with resistance at SPX 1991 and 2019.

Tomorrow we see weekly jobless claims at 8:30, then existing home sales, the Philly FED and leading indicators all at 10am.

SPX is about 5 handles from its intraday high. Could end up developing a bullish handle on that “cuppy” base.

The DOW looks like it wants to test the underside of the broken uptrend line (white line) that’s also just about where the old all time highs were.

The Nasdaq needed a rest and ended the day perfectly flat.

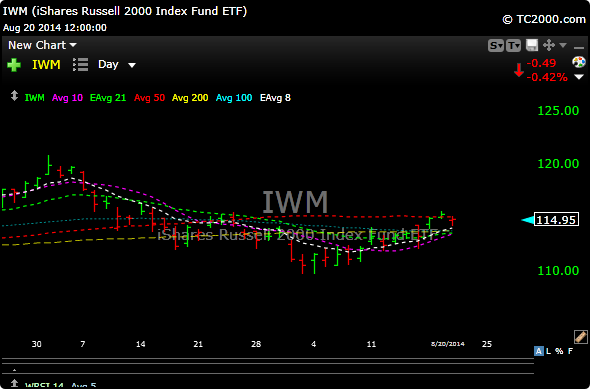

The Russell ended the day back under its 50 day moving average.

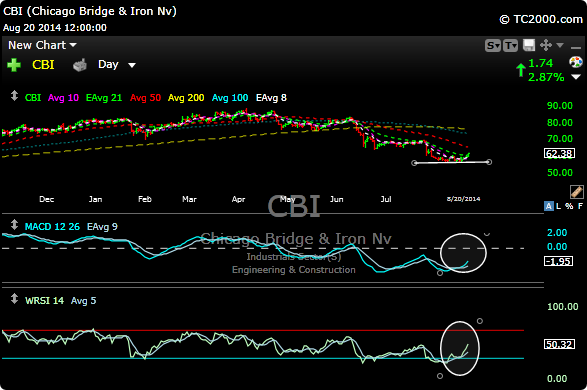

Tonight’s new addition is a name that is longer term swing trade. CBI is a big Warren Buffet name (he actually bought more recently). The stock has been hit hard and has dropped abut 30% since late May. Technical indicators such s RS (relative strength) and MACD are both crossing positive.

We don’t want to be long if it breaks support (white line), but over time (2-4 months) we could see a move back to the 70-80 zone. Buy the 61-63 zone. Stop 57