Now that the Dow Jones has given up all the years gains and the other indexes look like they could fall further through the trap door, everyone has an opinion about what will happen next.

Statistics are coming fast and furious and it is probably impossible to understand what is real and what is Memorex.

Here are a couple: (both posted from @ukarlewitz , great follow)

Equity put/call jumps to 1.04. Only similar were near SPX lows in mid June 2011 and August 2011 ..(so we going up?)

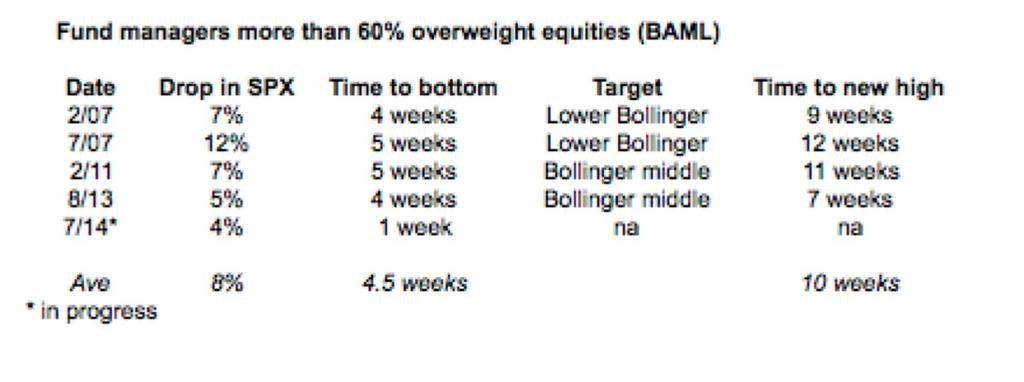

Then I see this:

When fund managers are more than 60% overweight equities, corrections to the bottom are usually at least a month long (so we going down?)

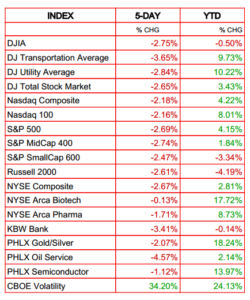

Here is a pretty picture from Josh Brown’s blog on the battle damage last week. Ugly.

Bottom line, I have read no fewer than 50-100 stats on where we are, where we were, and where we are going. All I can tell you is to watch price AND volume going forward. Big volume will be needed to flush this thing lower or to lift this thing back higher so it sticks.

Right now the DOW and Russell look the worst, as the former wrecked its uptrend and may want to tag its 200 day moving average which is about 150 points away. The Russell has broken every moving average. The bullish takeaway is that these two indexes may be closet to bottoming. Dow support 16,300 then 16,000 (roughly). IWM support is 108 which is the May lows.

I think we rip next week.

Premium subscriptions available here.