{+++} For the day the SPX/DOW were +0.45%, and the NDX/NAZ were +0.70%. Bonds gained 5 ticks, Crude lost $1.25, Gold rallied $7, and the USD was lower. Tomorrow: weekly Jobless claims at 8:30, Wholesale inventories at 10am, and a speech from FED vice chair Fischer after the close.

It was a decent effort by the bulls today and the Fed minutes were fairly boring. The two best acting sectors today were biotech $IBB and miners $GDX. Solar also performed well.

Not sure its time to go all in bullish, but it was a better day and more bullish action tomorrow would be a good sign.

Here are a few things I’m watching.

I know we got stopped on YELP but it may have put in a bullish candle today, so keep your eye on it.

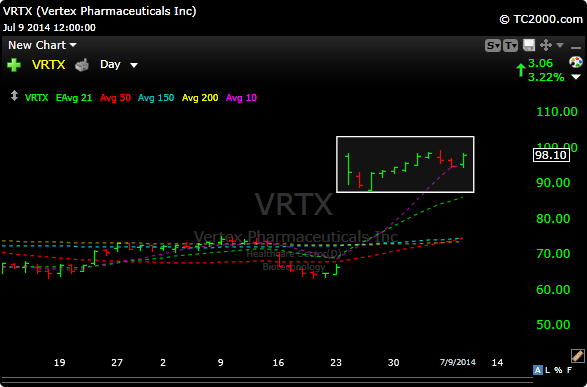

VRTX has been consolidating nicely since that spectacular breakaway gap recently. I mentioned this one today in the trading room as one to watch. If it gets though 99-100 I think it can tag 105-110

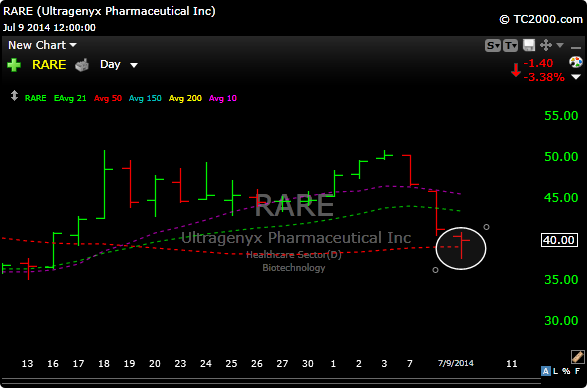

RARE is a very speculative idea, but it has seen some interesting events recently. The stock announced a secondary the other day. The timing was horrible because the market and especially the biotechs started to sell off hard. Anyway, the secondary was priced at 40, it broke that syndicate bid in the morning then guess what? It closed right at the syndicate pricing. Exactly. Obviously that means the bankers were defending that bid and brought it back. This is an interesting setup because you know your risk would be today’s low. Breaks that and you’re out. The stock also may be oversold as it is down 10 points in just the last few days. It also regained its 50 day moving average today.

So maybe 2 points risk and 5 to 10 points of upside.

See you in the morning.

Joe