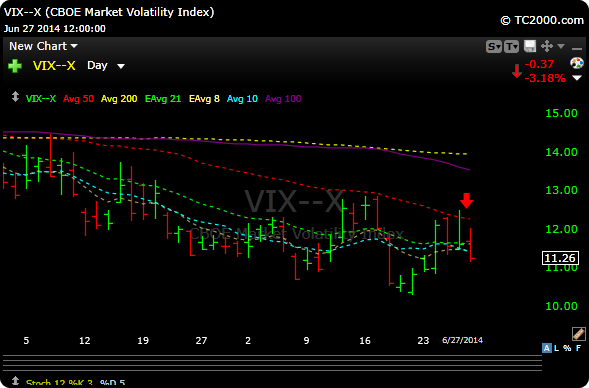

Well the $SPX had a down day on Wednesday, but then composed itself and managed three sideways, consolidation days for the balance of the week. The $VIX had a dead cat bounce to the underside of its 50 day sma on Wednesday and Thursday, but was rejected from higher levels on Friday. The VIX hasn’t had a close above its 50 day since mid April. Nice try bears.

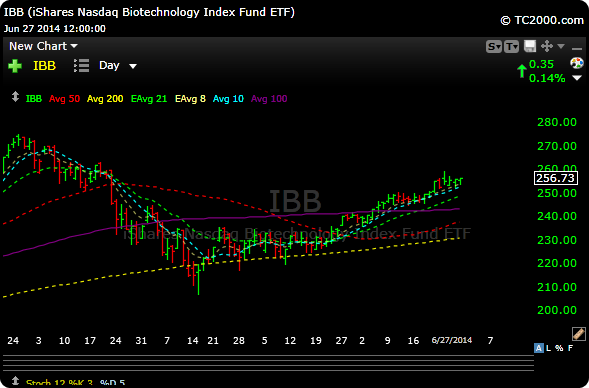

Biotech ($IBB) continues to look constructive and I still think we will see more M&A for the balance of the year.

Energy ($XLE) hit highs, but came down with everything else on Wednesday. It tried to recover though at the end of the week.

Financials ($XLF) still look decent to me and the banks held the 20day ma all week.

$GOOGL popped above a downtrend line last week and added 20 points.

$AAPL may be starting to curl up here. I think the fan boys are already getting curb space for the new phone.

$TWTR finally broke above some lateral resistance on Thursday with good volume and posted a bullish inside day on Friday. I think 45-47 is next.

The camcorder for your head ($GPRO) went public and ripped. I still think a couple of years from now it goes the way of the camcorder. Geeks may love this one, but they wont use it, because they are too busy getting cheese doodle dust on their laptops as they watch the world go by on a 15″ laptop.

I still think the best thing for this market would be a 3-5% pullback. It would shake out a little of the over-zealousness (not necessarily froth), and give us some better setup entries.

For more specific analysis and setups you can become a member here.

Subscriber returns for June can be reviewed here.