{+++} The markets were essentially flat today with the exception of the Russell 2000 which popped almost 1%. We saw three takeovers this morning as IDIX tripled after they announced they were getting bought by Merck. HITT was bought out and popped 28%. As a result of the IDIX takeover, the IBB index had a very strong day, but gave some back as the day progressed.

Naturally I’m growing cautious as we approach the nosebleed seats again, but so far there isn’t much to take down this market. The only thing that I can think of, is that they decide to use the uncertainty of the mid term elections as an excuse to sell stocks. But that situation may not become an issue for a month or two if at all.

The price of the VIX is getting silly as it hits lows almost on a daily basis. This implies zero fear and extreme complacency. Are things just really that good and or are we approaching a short term top? My trading experience tells me that when VIX gets this oversold, something dramatic happens. We just don’t see it yet.

Is it possible for the VIX to continue lower while stock prices go higher? I guess, but it pays to tighten stops up here.

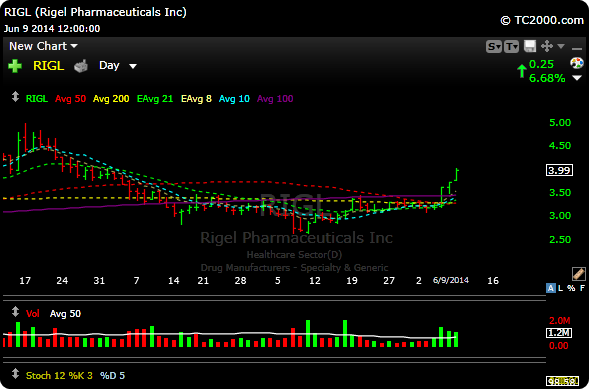

Some biotechs that got beaten down are starting to show signs of life. I want you to watch the following names and if they hit these prices buy them. They will be added to the P&L if they trigger.

RIGL-3.80-4.10 buy range

CYTR – 4.60-4.90 buy range

See you in the morning.