{+++}

For the day the SPX/DOW were mixed, and the NDX/NAZ were -0.30%. Bonds gained 5 tick, Crude slid 50 cents, Gold was flat, and the USD was higher. Medium term support remains at the 1869 and 1841 levels.

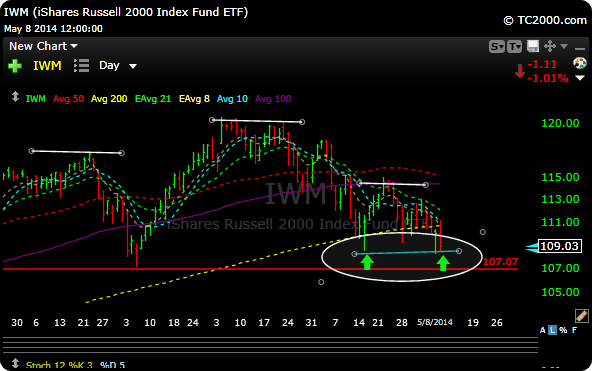

Tuesday was the first day that the Russell 2000 closed below its 200 day moving average since 2012. We closed below it yesterday and again today. You all know about the bearish head and shoulder pattern, but as you can see below its at the point where it better rally or lower prices are in store.

The Nasdaq (QQQ) doesn’t look much better. In the chart below you can see the small red uptrend line in the lower right. if that breaks lower, in my opinion, it will send the QQQ down to lateral support around the 82 level which is also down around 200 day moving average support (yellow line). Keep in mind that the Russell has already broken its 200 day moving average.

So what gives here? Is the Russell and Nasdaaq just getting their correction out of the way while the S&P and Dow just wait for them to turn higher? Or will there be so much negative pull form Russell and Nazzy that the S&P and Dow will have no place to go but down?

This is pretty much all I have been thinking about for two weeks now. If you put a gun to my head I think S&P and Dow will probably pull back 5-7%.

The next few days should tip us off as to what to expect in the coming weeks.