“Far more money has been lost by investors preparing for corrections or trying to anticipate corrections, than has been lost in corrections themselves” -Peter Lynch

Yeah, I know that Lynch quote sounds wicked perma bullish, but sometimes it just is what it is.

It’s that time of year where the institutions sell losers and either add to winners or initiate positions in winners so they can show it as a long.

Here are my fab five that should continue ramping.

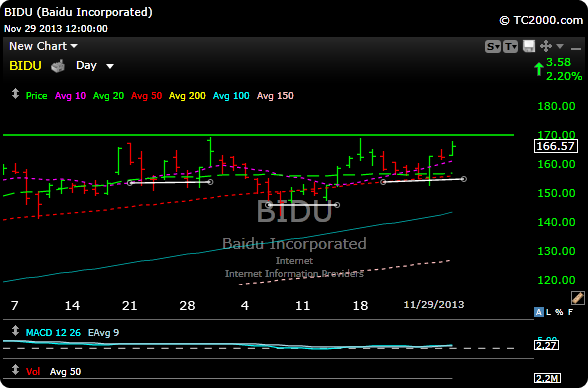

$BIDU appears to be forming an inverse head and shoulder pattern on the daily chart. The neckline is around the 170 level. It wouldn’t surprise me to see this one around 190+ by year end. Subscribers are long at 163

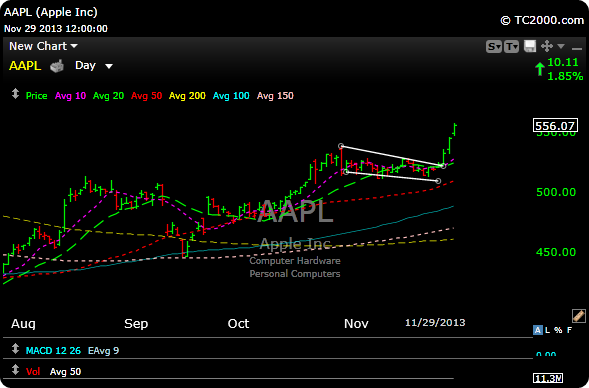

$AAPL The haters have been getting thumped on this one since it decided to break out of thewedge on Tuesday. Apple could have another 20- 30 in it by year end. Also check out the powerful base on the weekly chart. Subscribers got long at 525 on Monday.

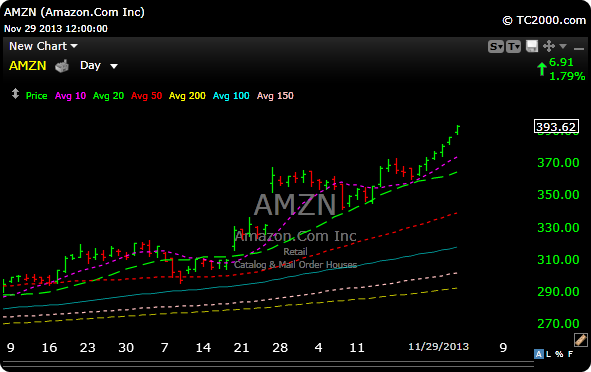

$AMZN is rocking, and shopping in your PJ’s isn’t a fad, especially if you want to avoid open wounds to your body at the mall. The stock is a little extended, but 400+ appears to be in the cards soon. This was a recent long in my trading room around 370.

$NFLX The haters are getting hurt again on this one. All time highs by year end is possible. Subscribers got long on Nov.22 at 350.

$FB may not be done going higher. It all depends on whether or not it can break out of this falling wedge, which I think it will. Watch the 47.50-48 level with volume. A breakout there should get it in motion again.

You can subscriber here to get the in depth Sunday video with more setups.