Now that we are waiting for Congress over the Syria issue, the question is do we rip on Tuesday morning, or do we cave because the market hates delay and uncertainty?

This week we are also looking at:

1- ISM Index

2- Fed Beige Book

3- Factory Orders

4- Friday is the Big Kahuna…..Non Farm Payrolls

Other data will be mixed in too. For my money, it’s the time to take a look at the weekly charts, not so much the daily charts. You will get a much better feel for support and resistance levels.

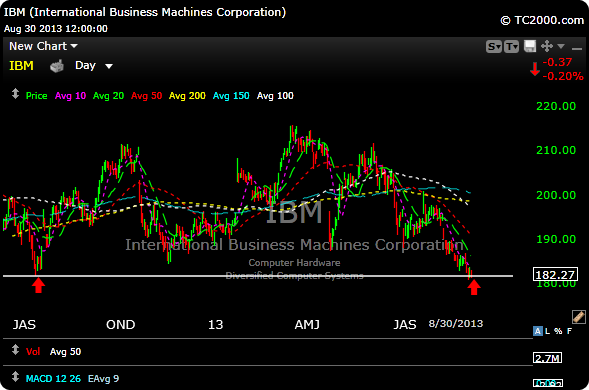

When you look at names like $IBM, it makes you wonder what the $DJIA could do going forward. It does look like it has another 10-15 bucks of downside. It is right on July 2012 support.

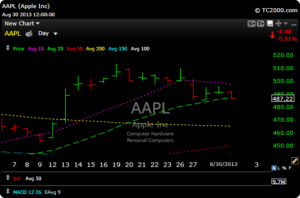

$AAPL quietly gave back about 5% in the last week or so, and closed right at its 20 day moving average on Friday.

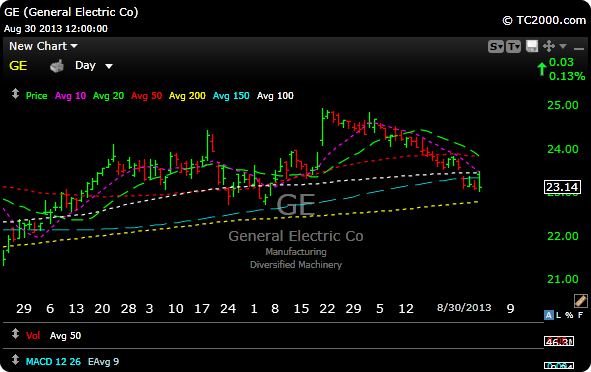

$GE which is a good “tell” on things is down almost 10% from its recent highs and it may want to tag that 200 day moving average before it gets going back to the upside.

Names like $TSLA and $Z don’t care about anything and continue their outer body experiences to the upside.

We’re closed on Monday, but we should get a sense of how things look before that, as Europe and Asia are live.

The bears have the edge here, but that can change on a dime. Respect the trend.