Looks like we are getting the treasury sell off that has been telegraphed since the Age of Pericles. Today the 10 year note $TNX broke out and so did the 30 year $TYX. The 10 year yield closed at around 2.75% up from about 2.17% in mid June. The big question is where yield will settle??? Here, or a little higher? We’ve been up at this level a few times and it didn’t hold. It’s in a range and will probably stay that way with a 2.50-3% range.

Unless you’ve been living in a cave, you know the move in rates will be up and not down, yet markets act stunned and surprised when bonds get a downtick. It didn’t help that $CSCO and $WMT screwed the pooch with their earnings, but lets face it, the market was overbought and needed a pullback. So we blame taper talk and the Fed. The market always needs to blame something. Let’s face it, $CSCO hasn’t led since the Allman Brothers were top 10 and we all know that people are unemployed or are working part time, so $WMT sucked. Give me something I didn’t know.

What we really have to worry about, is that the troglodytes in Washington are back from summer vacay soon and they will start their chest pounding about budgets, debt ceilings and immigration. All negative noise that the market doesn’t need right now.

There are only so many times Bernanke can come to the podium, change his mind (like last time) and save the day.

So where is the bond money going? Some goes to cash, but have you looked at Europe and emerging markets? $EEM is quietly up 10% over the last couple of months and European ETF”s are trading at highs. See $EWG, $EWI, $EWP and $EWQ. Many stocks that have exposure to Europe are +50% this year. I won’t chase that trade.

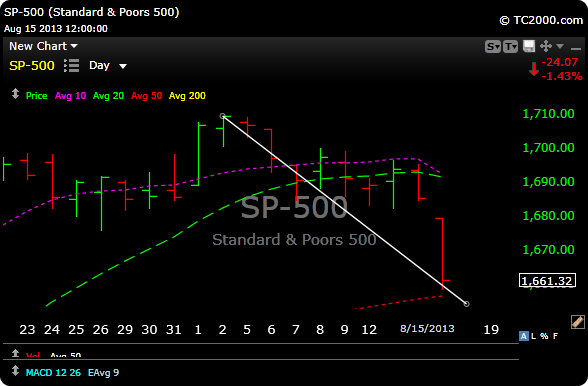

Today the Dow Jones splattered down through its 50 day moving average and the $SPX pretty much landed right on its 50 day.

The Russell 2000 $IWM is about a buck away from its 50 day moving average.

The Nazzy $QQQ closed just below its 20 day moving average, and if not for $AAPL this week, it would have been in much worse shape. Its 50 day support is about 2% lower. You can thanks Carl Icahn for that.

Egypt has gold and commodities upticking.

Housing stocks $XHB caught a big bid today even with rates moving up, so that is a little bullish, unless it was just a one day wonder.

I’m QE agnostic, but pulling the rug out while things suck so bad seems counterintuitive to me. But Ben knows best, at least that’s what the gang at the Fed thinks.

Things look like drek again, and all the pretty Picasso charts now look like Etch A Sketches that stepped on a landmine. They need work (and time) again.

The one trade that has worked for years now is buying the dip, I don’t really think this time is any different.

Stocks are getting repriced again. It always passes, but some damage has been done. SPX 1630 is possible if that 50 day doesn’t hold. Good trading. Nibble smart.

Come buy for a trial and trade with us on the chat room.