{+++}

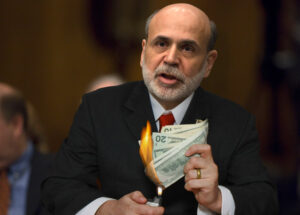

If you ran home at the bell today you missed all the “real” action. After the close, Bernanke pulled back on any hawkish rhetoric that he ever spoke and told everyone that rates will be zero until the end of life as we know it on planet earth. Cockroaches and rats will be crawling the earth’s surface until well after we’re gone, yet Ben’s printing presses will still be humming softly in the background.

The S&P ran about 13 handles higher on his comments after 4PM, and if futures it can hold overnight, we may see a very big day tomorrow.

No one expected this.

Bernanke didn’t really tell us anything new, but he did clarify his statements of a couple of weeks ago. Frankly, this will only prolong the agony of getting the markets reacclamated to an eventual tightening, but for now the tape should rip.

It was nice to see the market start to embrace a higher dollar and higher rates for a few weeks, now it will be back on the Fed feedbag, watching every grunt, groan and facial twitch from Bernanke and his Fed. Too bad in a way.

Housing stocks should rip again, while the dollar and rates will go lower, at least at first. It will be interesting to see what the financials will do. So the dynamic has changed once again. One thing that is constant is change right?

This changes currencies too. The Yen now will not be weak against our dollar now, and right now, the Eurodollar is ripping + 2.57% . Huge move.

Should be an interesting balance of July, especially with earnings coming hot and heavy.