{+++}

For the day the SPX/DOW were +0.55%, and the NDX/NAZ were +0.15%. Bonds gained 20 ticks, Crude slipped 40 cents, Gold rallied $14, and the USD was lower. Medium term support remains at the 1628 and 1614 pivots, with resistance at the 1680 and 1699 pivots. Tomorrow there is nothing scheduled ahead of the FOMC minutes on Wednesday.

The market gapped up at the open to start the week. By 10:00 it hit the high for the day. The rest of the day was spent in a minor pullback mode. Short term support remains at the 1628 and 1614 levels, with resistance at SPX 1636-1640 and SPX 1648-1649. Short term momentum hit extremely overbought this morning, then declined.

CYTX opened down this morning. Evidently they gave some placebos to some folks that should have gotten the actual drug. There were 400 or 500 people in the trial and this mistake involved about 40 people. The market absorbed the news and after the initial pullback the stock went on to make a new all time high. The company will be presenting along with other drug companies this week as the JMP Biotech conference. I think this stock will be a big winner this year and I hope options start trading on it soon.

I am adding two potential longs to the P&L tonight, so put them on your radar.

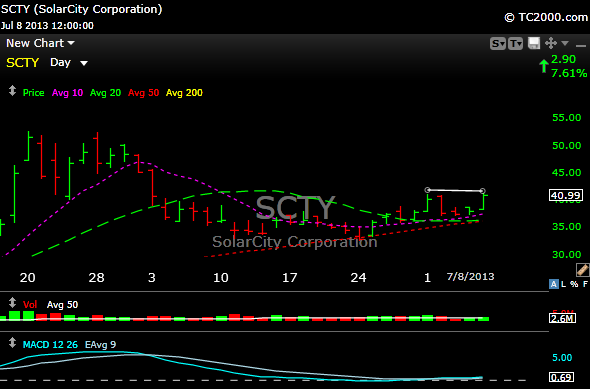

SCTY– I mentioned this one on the chat today but didn’t make it actionable. The solar plays are hot, and although many seem extended, SCTY seems to be consolidating nicely after its recent pullback. The MACD turned positive today and the volume is picking up. Buy the 41.33 level.

RAX– Has been beaten like a baby seal, but the technicals are improving. Buy the 41.72 level. If it gets over the 43.25 level it can get on the gap and make a move towards 45-49