I’ll feel better when the $SPX can get a close above this 50 day moving average. I’ve been writing about this a lot and unless and until it gets above it on a closing basis I’m not that impressed.

The same goes for $QQQ and the Dow 30 $DJIA. Both are at their 50 day resistance levels.

The Russell 2000 though has broken above. $IWM

Housing is interesting. It broke about a 2 year uptrend last month and now it is back up a bit and testing the underside of that trend line. This is a fail spot or a possible reversal higher area. $XHB

$XLF– Look at the absolutely ugly candle the financials put in today. This group will need to get its act together soon.

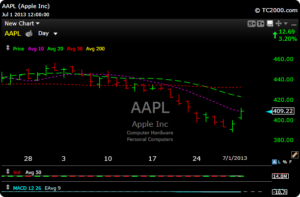

Some names that acted well today were $TSLA and $AAPL

$TSLA had a clean breakout on good volume and really doesn’t give a shit where the 10 year is trading.

$AAPL made a nice move today. Maybe Friday was the short term low, maybe not, but volume was decent last two days. Volume matters when a stock is trying reverse a trend.

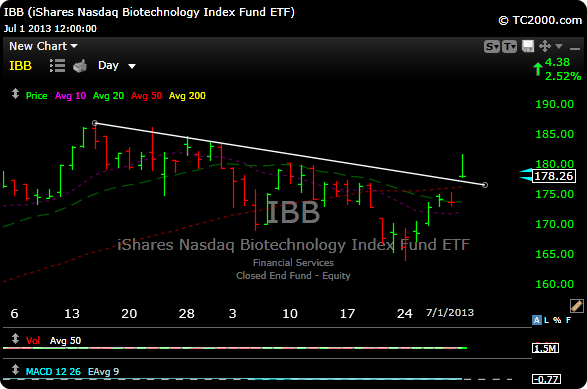

$IBB Biotech had a breakaway gap up today. This strength was brought on by $AMGN‘s 120 cash offer for $ONXX. The offer for ONXX was 120 the stock opened at 130. This one goes higher I think. IBB has rallied about 14 points off last week’s lows, but put in an ugly ass candle today after it gapped up through a downtrend line.

Some biotechs that looked great today were: $AMRI, $ARIA, $KERX, $AEGR and $CYTK.. The latter is trying to breakout and has a great story.

It’s probably going to be a traders summer. Good luck.

Free Trial Here

Performance request here